Testimony before the Subcommittee on Oversight and Investigations

U.S. House Committee on Energy and Commerce,

U.S. House of Representatives

January 17, 2024

Robert Rector

Senior Research Fellow

The Heritage Foundation

My name is Robert Rector. I am a Senior Research Fellow at The Heritage Foundation. The views I express in this testimony are my own and should not be construed as representing any official position of The Heritage Foundation.

SummaryREF

In the three years since taking office, the Biden administration has encouraged and facilitated 6.7 million inadmissible aliens to enter and take up residence in the U.S.

The impact of Biden policies can be seen by comparing the current situation with prior presidencies. In FY 2023, there were 3,201,144 encounters between inadmissible aliens and the

U.S. government nationwide. In 2016, the last year of the Obama administration, there were 690,433 such encounters. This 460 percent increase in inadmissible alien encounters is a direct and obvious result of Biden policies which deliberately encourage, facilitate and reward illegal immigration.

Homeland Security Secretary Alejandro Mayorkas recently admitted to his CBP agents that some 85% of current encounters with inadmissible aliens result in the individual being released into the interior. The government’s own data show that of the hundreds of thousands of inadmissible aliens encountered by Custom and Border Protection on the southwest border each month over 80 percent are being released into the U.S. interior. The policy is not so much “catch and release” as simply “greet and release”.

If current policies are continued, at least 10 million additional inadmissible aliens will enter and take up residence in the U.S. over the next five years. The only Biden response to this reality is to pretend it is not happening.

Illegal aliens in the U.S. generally have low levels of education. For example, at least, 40 percent of adult illegal aliens lack a high school degree compared to 6 percent of U.S.-born adults. Because they have low education and skill levels, illegal aliens tend to have lower wages and to receive much more in government benefits and services than they pay in taxes; on average, they receive

$2.40 in benefits and services for every $1.00 in taxes paid.

As a group, illegal aliens impose a net fiscal cost (government benefits received minus taxes paid) of $110 billion per year on U.S. taxpayers. How much is $110 billion? It is the equivalent of an 82 cent tax on every gallon of gas sold in the U.S. As the illegal alien population continues to grow rapidly, these costs will soar.

The left not only supports the massive ongoing wave of millions of illegal aliens into the U.S.; it also demands these illegals be given amnesty and citizenship. Amnesty would give illegals greater access to government benefits, further increasing taxpayer costs. If the current illegal alien population were granted amnesty, the net long-term cost to taxpayers would be $5 trillion. That is the equivalent of roughly $50,000 for each household currently paying income tax.

Illegal immigration undermines the wages and employment of less skilled American workers, particularly black males. Research reported by the National Academy of Sciences indicates the that low skill immigration may already have cut the wages and earnings of lower skill American workers by 30 percent.

The Explosive Growth of Illegal Immigration under the Biden Administration

To determine the overall net fiscal cost of illegal aliens it is important, first of all, to estimate the total number residing in the nation.REF This task has been made difficult by the rapid and enormous inflow of illegal aliens prompted by the new immigration and border policies of the Biden Administration. In the three years since Joe Biden assumed the presidency, some 6.7 million new inadmissible aliens have entered the nation and taken up residence.

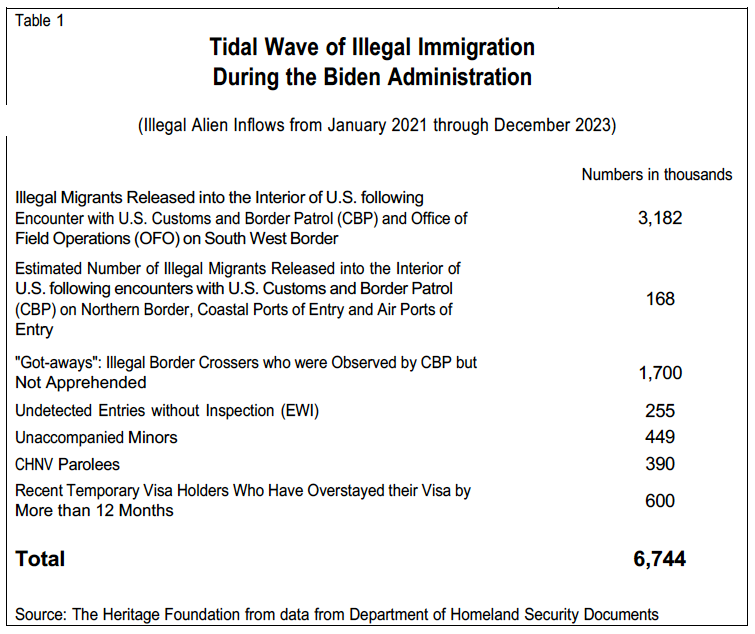

The breakout of this illegal alien inflow between January 2021 and December 2023 is as follows:

- Released illegal entrants on southwest border: 3.18 million. These are illegal aliens who have entered the country unlawfully, been encountered or apprehended by the Customs and Border Protection’s Border Patrol or Office of Field Operations, but then deliberately released into the nation by the Biden administration.REF

- Released inadmissible entrants on northern land border, air ports of entry and coastal border: 168,000. These are illegal aliens who have entered the country unlawfully between ports of entry or without documentation at ports of entry, been encountered by the Customs and Border Protection, but then deliberately released into the nation by the Biden administration.REF

- “Got-aways”: 1.7 million. These are unlawful aliens that the border patrol observed crossing the border but were unable to apprehend.REF

- Undetected entries without inspection: 255,000. The Border Patrol estimates the number of undetected entries without inspection (EWI) on the border; these are individuals who are likely to have unlawfully crossed the border without being observed by the Border Patrol.REF

- Unaccompanied minors: 449,000 These are individuals who claim to be minors and have entered the nation without legal authorization and without an accompanying adult.REF

- CHNV Parole Program: 390,000. In January 2023 the Biden Administration created a new “parole” program in which individuals from Cuba, Haiti, Nicaragua, and Venezuela will be flown directly into the U.S., bypassing border control and normal immigration procedures.REF

- Longer-term visa overstays: 600,000. This category represents the estimated inflow of temporary visa holders whose visas expired in FY 2021, 2022, and 2023 but who currently remain in the U.S. beyond their legal departure deadline.REF

Total illegal alien inflows: 6.74 million. Summing the above figures shows that some 6.7 million illegal aliens entered the nation from January 2021 through December 2023. (See table 1 at the end of the paper.)

Explosive Growth in Illegal Entries

The extraordinary illegal alien inflows described above are unprecedented. The destructive impact of Biden policies can be seen by comparing the current situation with prior presidencies. In FY 2023, there were 3,201,144 encounters between inadmissible aliens and the U.S. government nationwide. In 2016, the last year of the Obama administration, there were 690,433 such encounters. REF This 460 percent increase in illegal alien inflows is a direct and obvious result of Biden policies which deliberately encourage, facilitate and reward illegal immigration.

Under Biden policies, most “encounters” between illegal aliens and border officials result in the illegal alien being simply released into the U.S. For example, at present, over 80 percent of the hundreds of thousands of illegal aliens encountered each month on the southwest border by Custom and Border Protection appear to be released into the U.S. interior. REF The current policy is not so much “catch and release” as simply “greet and release”.

Current Number of Illegal Aliens

The number of illegal aliens in the United States has been estimated periodically by the Office of Immigration Statistics in the Department of Homeland Security (DHS).REF These estimates use an analytic technique called the residual method.REF This procedure has three steps. First, the number of foreign-born persons appearing in annual Census surveys is estimated. Second, the correct number of legal immigrants and naturalized citizens who should reside in the U.S is estimated.

Third, once this estimate of the legal foreign-born population is made, any additional foreign- born persons appearing in annual Census surveys are deemed to represent the illegal migrant population. (Note: This system assumes that nearly all illegal aliens will respond to annual Census surveys and will be included in Census data.)REF

A number of non-governmental groups, such as the Center for Immigration Studies, the Center for Migration Studies and the Pew Research Center, use variants of this method.REF The most recent and thorough count of illegal aliens has been completed by Steven Camarota, Director of Research at the Center for Immigration Studies. Using data from the monthly Census Current Population Survey, Camarota estimates there were 10.22 million illegal migrants in the U.S. on January 2021 when President Biden took office.REF

Since then, 6.7 million additional illegal aliens have entered the country as shown in table 1. Adding the 6.7 million to the initial base of 10.22 million would yield a present illegal population of 16.9 million. However, this figure would be too high as it allows for no attrition in the base population. Over time some illegals will return to their country of origin, others will die. Although precise numbers are not available, it is likely that attrition has reduced the base population by perhaps one million over three years.REF This would leave a residual of around 15.9 million illegal aliens at present.

The Net Fiscal Cost of Lower Skill Households

Both the size and composition of the illegal alien population are important for public policy. Lower skill U.S.-born citizens, legal immigrants, and illegal aliens all impose large net fiscal costs on U.S taxpayers.REF Net fiscal costs occur when the cost of the total government benefits and services received by a group exceeds the total taxes paid by the group. This imbalance creates a net fiscal deficit which must be paid by others in society.

In calculating the net fiscal balance of legal immigrants, illegal aliens, and/or U.S.-born citizens, four types of government benefits and services are relevant. These are:

- Direct benefits. Direct benefits include Social Security, Medicare, unemployment insurance, and workmen’s compensation.REF

- Means-tested welfare benefits. Means-tested benefits are available only to poor and lower income persons. There are over 90 of these programs which, at a cost of over $1.2 trillion per year, provide cash, food, housing, medical, and services to roughly 80 million low- income Americans. Major programs include Medicaid, Food Stamps, the refundable earned income tax credit, public housing, Supplemental Security Income, and Temporary Assistance to Needy Families.

- Public education. At an average annual cost over $15,000 per pupil, these services are largely free or heavily subsidized for low-income parents.REF

- Population-based services. Population-based services include police, fire, highways, parks, and similar services. As the National Academy of Sciences has explained in its studies on the fiscal cost of immigrants, these services generally have to expand as new immigrants enter a community; someone has to bear the cost of that expansion.REF

Public goods such as national defense and scientific research are not included in the calculation.

While households receive large-scale benefits and services from government, they also pay taxes to government. The most important taxes at the federal government level are the personal income tax, Federal Insurance Contribution Act (FICA) taxes for Social Security and Medicare, corporate profit taxes, and federal excise taxes. At the state and local level, the most important taxes are property taxes, income taxes, and general and selective sales taxes. For the calculation to be accurate all taxes paid by a household, both direct and indirect, should be included.

The Vast Redistributive State

The debate about the fiscal consequences of illegal and low-skill immigration is hampered by a number of misconceptions. Few lawmakers really understand the current size of government and the scope of redistribution. Government is far larger and more expensive than most imagine. In 2019, before the COVID-19 pandemic, federal, state, and local governments spent $5.76 trillion on direct benefits, means-tested aid, education, and population-based services. Across the whole population (including U.S.-born citizens, legal immigrants, and illegal aliens), the average household received $44,800 in government benefits and services.REF Households headed by persons without a high school degree got considerably more, perhaps as much as $65,000 per household.REF

The cost of government benefits and services received minus the total taxes paid by a household equals the net fiscal balance of the household. Households that pay more in overall taxes than they receive in direct and means-tested benefits, education, and population-based services are net tax contributors. Households that receive benefits and services in excess of the taxes they pay are net tax consumers.

The governmental system is highly redistributive. Households with higher earnings tend to be net tax contributors. On average, well educated workers earn more income. For example, immigrants with a college education (who are overwhelmingly legal immigrants) pay enough in taxes to fund the government benefits and services their families receive while generating a fiscal surplus that can be used for other government purposes. By contrast, less educated households, on average, are net tax consumers—the benefits they receive exceed the taxes they pay—these households generate a “fiscal deficit” that must be financed by taxes from other households or by government borrowing. This is largely true irrespective of whether the household is headed by a citizen born in the U.S., a legal immigrant, or an illegal alien.

Education Levels of Foreign-Born Immigrants and Native-Born Citizens

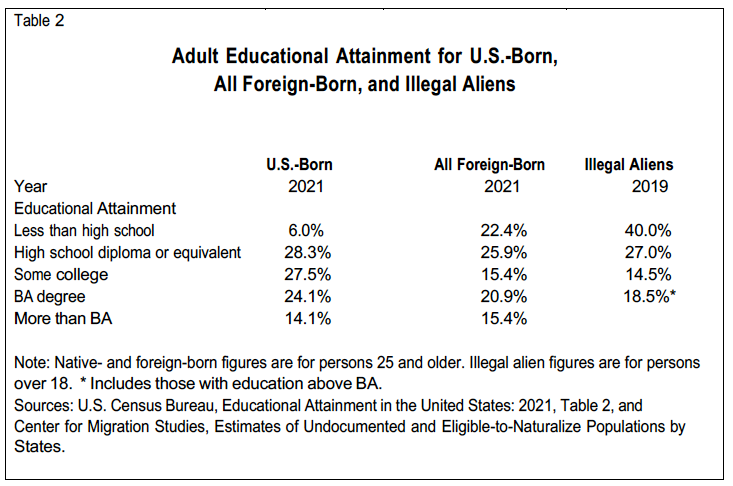

Immigrants tend to impose higher fiscal costs on society because, on average, they have lower education levels than U.S.-born citizens. Table 2 (at the end of the paper) shows the education levels of adults in three groups. The first is U.S.-born citizens. The second group covers all foreign-born adults, including former immigrants who have been naturalized, legal immigrants, and illegal aliens. The third group is a sub-group of the second group: it includes only illegal aliens.

The three groups differ considerably in the share of adults with very low levels of education. Among native-born adults, only 6 percent lack a high school degree. Among all foreign-born, the number is 22.4 percent, and among illegal alien adults it rises to 40 percent. Individuals with this low level of education tend to generate high fiscal deficits, receiving more government benefits and paying less in taxes.

Moreover, the figures in Table 2 measure education levels before the explosive growth of illegal immigration over the last three years (as discussed above).REF The dramatic surge in border crossing will almost certainly increase the share of less educated illegal aliens in the U.S., thereby increasing net fiscal costs.

National Academy of Sciences Confirms the High Cost of Low-Skill Immigration

Some claim that lower skill immigrants do not produce fiscal burdens on U.S. taxpayers because they do not receive means-tested welfare. This is wrong in multiple respects. In reality, legal migrant households receive significantly more welfare, on average, than U.S.-born households.REF In addition, the fiscal burden generated by lower skill legal immigrants is not principally due to means-tested welfare. Although the welfare benefits received are large, the combined benefits received from Social Security, Medicare, public education, and population-based services are significantly larger. Even if the entire means-tested welfare state were abolished, lower skill immigrants would remain a substantial fiscal burden, receiving much more in government benefits and services than they pay in taxes.

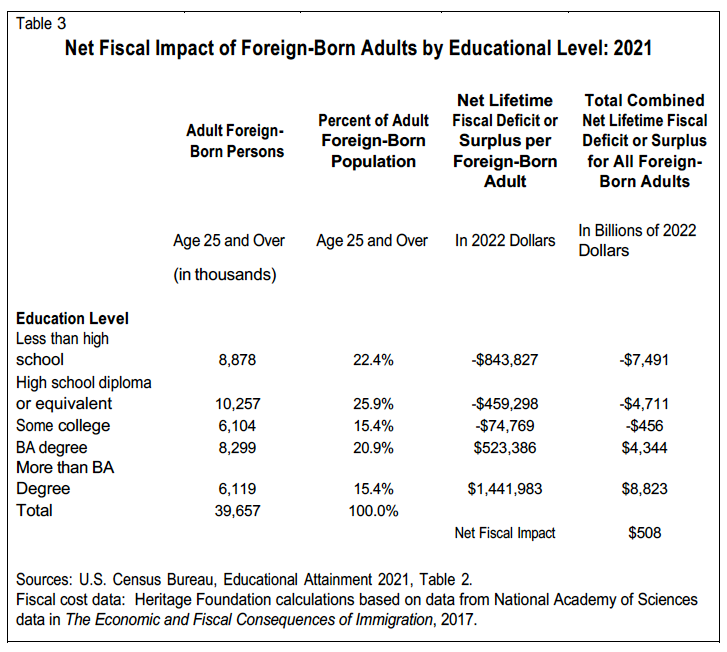

An extensive study by the National Academies of Science (NAS), The Economic and Fiscal Consequences of Immigration, provides a n analysis of the fiscal costs of immigrants along the lines described above. The analysis covers legal immigrants and illegal aliens and does not differentiate between the two. The NAS study confirms that immigrants (both legal and illegal) with low levels of education impose large fiscal burdens on U.S. taxpayers.REF According to NAS analysis,REF over the course of a lifetime, an immigrant without a high school degree will receive some $844,000 more in government benefits and services than he will pay in total taxes.REF An immigrant with only a high school degree will receive $459,000 more in benefits and services than he pays in taxes.REF

It is sometimes argued that the fiscal costs of first-generation lower skill immigrants are irrelevant because their children, experiencing upward social mobility, will become strong net tax contributors generating strong fiscal surpluses that counteract the initial deficits of their parents. In reality, although the children of lesser skilled immigrants will attain more education than their parents, on average, even with this attainment, they will produce net fiscal deficits.REF The NAS figures used in this text include both first- and second-generation costs; for lower skill immigrants both generations have a negative fiscal impact.REF

Table 3 shows the results of the NAS study. The table shows that higher skill immigrants (with a college degree or higher) pay significantly more in taxes than they receive in benefits over the course of a lifetime. In aggregate, these individuals will generate some $13 trillion in fiscal surpluses over their lives. In theory, these surpluses could be used for important social purposes such as reducing the national debt or funding defense. In reality, this will not happen because nearly all the fiscal surpluses generated by well-educated immigrants are offset by the nearly equivalent fiscal deficits generated by less educated immigrants. Immigration does not contribute to the fiscal solvency of the United States because the positive contributions of high-skill immigrants are neutralized by the fiscal costs of low-skill immigrants.

Moreover, the figures in Table 3 do not include the mass surge in illegal immigration that occurred in the last three years. That surge will increase the negative fiscal costs of immigration well above the figures in the table.

The Fiscal Cost of Illegal Aliens

As with the case of low skill immigrants in general, some claim that illegal aliens do not produce fiscal burdens on U.S. taxpayers because they do not receive means-tested welfare. This is wrong in multiple respects. It is true that illegal aliens (in contrast to legal immigrants) do not, at present, have access to most means-tested welfare programs.REF They are also currently ineligible for Social Security and Medicare benefits. However, this does not mean that they do not receive government benefits and services.

Many illegal aliens have U.S.-born children; these children are eligible for the full range of government welfare and medical benefits. The children of illegal aliens are also fully eligible for free public education; the average cost of which is now roughly $15,000 per year. And, of course, when illegal aliens live in a community, they use roads, parks, sewers, police, and fire protection; these services must expand to cover the added population or there will be “congestion” effects that lead to a decline in the service quality.REF

While illegal aliens do receive less government benefits and services than comparable U.S. citizens there is a second powerful factor that drives up the net fiscal costs of illegal aliens relative to the rest of the U.S. population: as noted, illegal aliens as a group have very low levels of education.

As Table 2 showed, illegal aliens have low education levels relative to legal immigrants and native- born individuals. Some 40 percent of adult illegal aliens lack a high school degree compared to 6 percent of native-born adults. Roughly 30 percent of illegal alien adults have eight years or less education. On average, illegal aliens receive $2.40 in government benefits for each $1.00 they pay in both direct and indirect taxes.REF The average illegal alien household has an annual fiscal deficit over $20,000

Current Net Cost of Illegal Aliens

With a current population of 15.9 million illegal aliens, provided above, the current net fiscal cost of those immigrants is around $110 billion per year.REF This means they receive $110 billion more in government benefits and services than they pay in total taxes.REF The figure $110 billion is so large it is difficult to grasp. In simple terms, to pay for $110 billion in net expenditures, government would need the raise the tax on gasoline by 82 cents per gallon.REF Of course, government would never fund illegal immigration in this transparent way. In reality, these costs are spread across a wide range of taxes or are funded by deficit spending that must be paid by future generations.

Moreover, as noted, the illegal alien population has been growing rapidly following the changed border and asylum policies imposed by the Biden Administration. If current trends continue, the illegal migrant population will grow explosively with at least 2 million incoming illegals each year. Assuming a current base of 15.9 million illegal immigrants and an addition of 2 million new illegals each year, and with normal attrition on the overall illegal population, within five years there will be 23.1 million illegal aliens residing in the U.S.REF The net cost to taxpayers will rise to at least $160 billion per year (in 2023 dollars).

The Cost of Amnesty

The Biden Administration and the left in Congress also continually press for amnesty for illegal aliens. Amnesty would entitle current illegal aliens to full benefits from all means-tested welfare programs, Social Security, and Medicare. The NAS analysis provides estimates of the long-term net fiscal costs of immigrants by their education level. Analysis based on these NAS figures permits a rough estimate of the net fiscal costs of illegal aliens following amnesty. Analysis using the the NAS figures indicates that granting amnesty to 15.9 million current illegal aliens would impose estimated total lifetime net costs on the U.S. taxpayers of at least $5 trillion (in constant 2023 dollars).REF This averages to around $50,000 for each household currently paying federal income tax.

These costs substantially understate real long-term costs of amnesty to the taxpayer because they cover only the costs of illegal aliens who are already present in the U.S. and do not cover the millions of future illegal aliens who will flow into the nation if current government policies are continued. Given current trends, the illegal population will rise to 25.6 million by 2030. The net cost, following amnesty, for this group would be around $8 trillion (in 2023 dollars), on average around $80,000 for each taxpaying household.

New York City Mayor Confronts Open Borders

The impact of the mass influx of new illegal immigration has led New York City Mayor Eric Adams to proclaim that open borders and the unending flow of “asylum seekers” is destroying New York City. The Mayor urged the federal government to declare “a state of emergency to manage the crisis at the border.”REF

Adams warns that the overwhelming influx of illegal aliens will force New York to house and feed on “average nearly 33,860 households nightly this fiscal year” with annual costs of more than $4.7 billion. The Mayor predicts the annual costs will rise to $6.1 billion per year by FY 2025.REF The Mayor warned New York residents: “This is going to come to a neighborhood near you…. Never in my life have I had a problem that I did not see an ending to. I don’t see an ending to this…. This issue will destroy New York City…. The city we knew we’re about to lose.”REF

The Impact of Illegal Immigration on Low Skill and Minority Workers

Illegal immigration is disproportionately low skilled, and the negative impacts of lower skill immigration can be especially severe on the least-advantaged American workers.REF Low skill immigration inflows over recent decades have contributed to wage stagnation among the bottom half of workers and have undermined the earnings and employment of vulnerable groups such as black males and workers without a high school degree.

As Rep. Barbara Jordan (D-TX), chairwoman of the bipartisan U.S. Commission on Immigration Reform in the mid-1990s explained, policy makers must be “particularly concerned about the impact of immigration on the most disadvantaged within our already resident society – inner city youth, racial and ethnic minorities, and recent immigrants who have not yet adjusted to life in the U.S.”REF The Jordan Commission concluded that “the principal ‘losers’ [of immigration] are the low-skilled workers who compete with immigrants and whose wages fall as a result.”REF The Commission found “no national interest in continuing to import lesser-skilled and unskilled workers to compete in the most vulnerable parts of our labor force.”REF

The recent report by the National Academy of Sciences, The Economic and Fiscal and Consequences of Immigration provides extensive evidence concerning the potential negative effect of low skill immigration on low skill native workers especially “native minorities.”REF For example, the study focuses 17 separate analyses on a variety of low-skill, non-immigrant groups; all but two of these confirm standard economic theory and show that low skill immigration has reduced the wages on low skill, non-immigrant labor.REF On average, the analyses showed that an inflow of immigrant labor resulting in a one percent increase in the supply of low skill labor would result in a 0.6 percent drop in the wages of low skill non-immigrants. Since immigrant workers represent over half the workforce without a high school degree, this indicates that immigration may have cut the wages of low skill native American workers by as much as 30 percent.

Extensive review of economic literature confirms the NAS report. Of 89 studies of the impact of immigration in the U.S on native workers without a high school degree or native black workers, 77 confirm standard economic theory showing immigration has negative effects on earnings or employment.REF (A list of these studies is available on request.)

Especially troubling is the negative impact on black Americans.REF Between 1960 and 2000, the employment rate of black high school dropouts fell catastrophically from 72 percent to 42 percent. Research by Harvard economist George Borjas and others found that an increase in lower skill immigrant labor led to a substantial drop in wage and employment among similarly skilled blacks and a noted increase in black incarceration.REF Decreasing black male wages and employment contributes to family breakdown. Borjas’ analysis is corroborated by many other studies; of 50 studies analyzing the impact of immigration on black workers, 41 show negative effects on earnings or employment.REF

Further Economic Effects of Immigration

Advocates of increased immigration often assert that all immigrants, including illegal immigrants, enlarge the economy or GDP. They imply, from this, that all immigrants therefore boost the standard of living of U.S. citizens. While it is true that immigrants inherently increase the size of GDP, this does not mean that, in consequence, they raise the standard of living of current citizens. Immigrants have a different effect on GDP as an aggregate and on GDP per capita (which measures the standard of living of the U.S. populace).REF

For example, assume there is a factory with ten workers, each making $40,000 per year. The total output of the factory is ten times $40,000 or $400,000. Another worker is added; he also is paid $40,000. Because of the extra worker, the output of the factory expands to $440,000. The extra worker has increased the total factory output by 10 percent, but the wages (or standard of living) of the initial workers remain unchanged. In this example, the extra worker is equivalent to an immigrant, the factory output is equivalent to GDP, and the wages of the initial workers are equivalent to the per capita GDP of current citizens. The fact that the total output of the factory has increased does not mean that the standard of living of the initial workers has improved.

As in the factory example, immigration increases the GDP, but it does not, generally, raise the per capita GDP or standard of living of current citizens. There is widespread agreement on this point in the field of economics. The National Academy of Sciences in another formal study of immigration, The New Americans, proclaimed:

Immigration will affect only the size of the economy: more GDP will be produced. The United States will be a bigger economy, but the average income of all its inhabitants will remain unchanged…. [Increasing immigration] will not change the well-being of natives as measured by their per capita income.REF

Harvard economist George Borjas, the nation’s leading immigration economist, amplifies on this point. According to Borjas, immigrant workers (legal and illegal) “in the labor market make the U.S. economy (GDP) an estimated 11 percent larger ($1.6 trillion) each year.” But of “the $1.6 trillion increase in GDP, 97.8 percent goes to the immigrants themselves in the form of wages and benefits.” REF In other words, while immigrants make the U.S. economic pie bigger, they consume nearly all of the increase through their own wages.

Immigration and Technology Change

Some contend that mass lower skill immigration and illegal immigration spur technology and productivity growth.REF The NAS report does state that immigrants with high levels of technical and scientific education spur technological innovation which may “increase productivity of natives, very likely raising economic growth per capita.” The number of patents produced is used as a proxy for technological change.

It is true that immigrants with a college degree are twice as likely as U.S.-born college graduates to obtain a patent. (This difference in patenting occurs because college-educated immigrants are more likely to have degrees in science and technology than are college graduates born in the U.S.) However, only 12.4 percent of recent immigrants have a STEM (science, technology, engineering, or math) degree, and only one-third of those (or 4 percent of all immigrants) are employed in a STEM occupation.REF Overall, less than 1 percent of immigrants produce patents.REF Thus the overwhelming majority of the millions of immigrants arriving in the U.S. each year are irrelevant to technological change and accompanying productivity increases.

Mass lower skill immigration and, illegal immigration, in particular, are neither efficient nor necessary mechanisms to promote technology change and productivity growth. To the extent that such immigration promotes greater government spending, higher taxes, and larger government deficits, it will impede not promote positive change.

Conclusion

The current population of illegal aliens imposes substantial net fiscal costs of at least $110 billion per year on U.S. taxpayers. The border security and immigration policies established by the Biden Administration have caused a dramatic and precipitate rise in the flow of illegal aliens into the U.S.

Some 6.7 million new illegal migrants have entered the U.S. and taken up residence since the start of 2021. If these policies remain in effect, the illegal alien population will continue to grow rapidly, reaching over 24 million persons by 2029. Net fiscal costs would rise to at least $169 billion per year.

In addition, the Biden Administration has continually promoted amnesty for illegal aliens. This would lead to even greater future costs by giving present illegal aliens full eligibility to all welfare programs, Social Security benefits, and Medicare. Analysis based on National Academies of Science figures indicate that amnesty for the current illegal alien population would impose long- term costs of around $5 trillion (in 2023 dollars). These costs, however, would be only a small down payment as both current policies and amnesty will incentivize ever larger illegal alien inflows in future years.

*****

The Heritage Foundation is a public policy, research, and educational organization recognized as exempt under section 501(c)(3) of the Internal Revenue Code. It is privately supported and receives no funds from any government at any level, nor does it perform any government or other contract work.

The Heritage Foundation is the most broadly supported think tank in the United States. During 2023, it had hundreds of thousands of individual, foundation, and corporate supporters representing every state in the U.S. Its 2023 operating income came from the following sources:

Individuals 82%

Foundations 14%

Corporations 1%

Program revenue and other income 3%

The top five corporate givers provided The Heritage Foundation with 1% of its 2023 income. The Heritage Foundation’s books are audited annually by the national accounting firm of RSM US, LLP.

Members of The Heritage Foundation staff testify as individuals discussing their own independent research. The views expressed are their own and do not reflect an institutional position of The Heritage Foundation or its board of trustees.