Americans are justifiably unhappy with the state of the economy.

The inflation figures for August took a turn for the worse—meaning families have now lost $5,100 in purchasing power since President Joe Biden entered the White House.

In addition to the burden of inflation, rising interest rates are making home mortgages unaffordable, pushing the American dream out of reach for millions.

While month-to-month economic numbers tell part of the story, a new report from The Heritage Foundation explains how Washington’s reckless spending pushed the economy to this tipping point. (The Daily Signal is the news outlet of The Heritage Foundation.)

The special report, “The Road to Inflation: How an Unprecedented Federal Spending Spree Created Economic Turmoil,” reveals that Congress passed an astonishing $7.5 trillion in new spending between 2020 and 2022—or more than $57,000 per household.

Pushing such an unprecedented amount of deficit spending had predictable consequences.

>>> Read the full report here: “The Road to Inflation”

At a time when supply chains were strained by the COVID-19 pandemic and harmful government-imposed lockdowns, throwing more money at a lower volume of goods and services could only drive prices up.

It would be one thing if the spending spree had been made up of good investments. Unfortunately, most of the initiatives were poorly designed, based on faulty economic reasoning and/or motivated by political opportunism.

The following are just four of the areas where the federal government misused trillions of dollars in taxpayer resources during the spending spree:

Welfare Expansion Causes World Record Fraud

At the start of the pandemic, Congress expanded eligibility and increased payments for the unemployment insurance program.

At the time, it was easy to predict that this would have negative consequences, incentivizing workers to actively seek joblessness or otherwise game the system to maximize their handouts.

Incredibly, even the most cynical analysis underestimated just how big a problem would result from this welfare expansion.

A combination of individual scammers and organized crime rings using identity fraud bilked the federal government for at least $100 billion, with upper-end estimates of $350 billion to $400 billion.

To put that in perspective, the Bernie Madoff scheme that generated extensive media coverage and numerous documentaries was worth $65 billion. (Naturally, the press is less interested in publicizing fraud enabled by a welfare program.)

Slush Funds for State, Local Governments

In addition to increased federal payments for mass transit, education, and Medicaid, the spending spree included a whopping $500 billion in few-strings-attached handouts to state and local governments.

The first batch of this money, $150 billion, was approved as protection against potential tax revenue declines at the start of the pandemic. However, it soon became clear that most areas were not experiencing a tax decline, and the total amount of revenue loss was much smaller than expected.

Despite that reality, Democrats passed an additional $350 billion in slushy funds.

Since there was no revenue gap, state and local governments blew through their second round of handouts with inflationary check-cutting, record-setting levels of corporate welfare, bailing out government-owned golf courses, tax credits for Hollywood studios, promoting tourism, special bonuses for government employees, and much more.

As with the unemployment insurance fraud, we will never know the total amount of money wasted on “relief” payments to state and local governments.

Teachers Unions Held Schools Hostage

Perhaps the most infuriating part of the spending spree took place in early 2021.

Amid a raging debate about reopening schools, with children receiving substandard educations, teachers unions were pressing to keep schools closed. That was part of a pressure campaign to give government-run K-12 schools a massive federal handout.

The Biden administration kowtowed to teachers unions, and it was later revealed that officials at the Centers for Disease Control and Prevention colluded with union officials on school-reopening guidance to help stack the deck.

In the end, Democrats approved $123 billion for public K-12 schools, rewarding the unions for holding schools hostage.

Since there was no pandemic-related need for such a huge amount of money, much of it went toward hiring sprees and raises for school employees.

Regrettably, the obscure nature of how funds were distributed means that we will likely never know what public schools did with that windfall.

Business Support Program Defrauded

The Paycheck Protection Program, passed early in the pandemic, was designed to help businesses keep employees on the payroll during the lockdown-driven economic downturn.

However, the $835 billion program—with Congress intending to get money out the door quickly—suffered from a lack of guardrails. Hundreds of billions of dollars in spending were flagged for review. There were hundreds of billions of dollars in improper payments, and the volume of fraud overwhelmed the system.

While some violators (such as a man who used the program to buy a $57,000 Pokémon card) were caught, countless others got away scot-free.

Conclusion

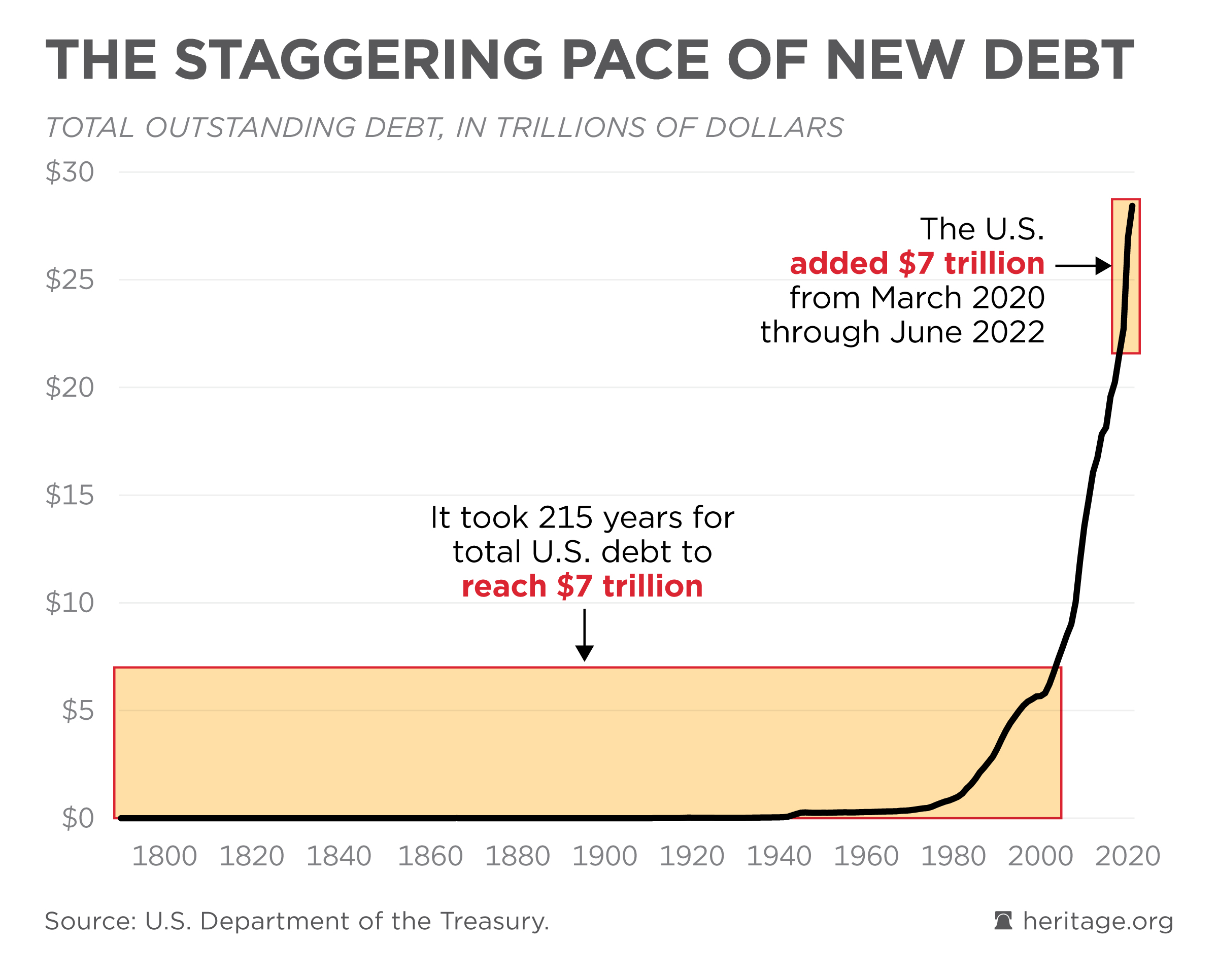

In the wake of the spending spree, the national debt is now more than $33 trillion, or an average of $253,000 per household.

Ignoring the dangers of such an incomprehensible amount of debt, and ignoring the ongoing damage that elevated inflation is having on family finances, many in Washington are still determined to keep the federal gravy train rolling.

- The pending set of appropriations bills are loaded with pork, including goodies for left-wing activist groups and frivolous recreational projects.

- These bills also contain tens of billions in fraudulent budget gimmicks that hide spending.

- Several other measures that would or could increase spending are also looming on the horizon, including the so-called farm bill (where most of the money goes to welfare programs), and supplemental appropriations that would throw tens of billions more at Ukraine and to leftist nonprofits that encourage illegal immigration.

It’s crucial for the American public to be on guard against politicians whose default response to most problems is to throw other people’s money around.

That has been a bad habit for many years, but now it has turned into a chronic addiction the country can’t afford.

This piece originally appeared in The Daily Signal