As New Hampshire hunkers down for another brutal January, lawmakers are giving families something to look forward to once the snow melts: namely, more opportunities.

The state House of Representatives on Jan. 3 voted in favor of an education savings account proposal, which would give families and students more options for where and how a child learns. The proposal has already cleared the state Senate.

With an account, the state deposits a portion of a child’s funds from the state education funding formula into a private account that parents can use to buy educational products and services for their children. Lawmakers in Arizona, Florida, Mississippi, Tennessee, Nevada, and North Carolina have enacted similar laws.

These accounts allow families to hire a personal tutor for their student, find educational therapies for children with special needs, or pay private-school tuition, to name a few possible uses.

Americans need an alternative to the mainstream media. But this can't be done alone. Find out more >>

Students cannot use an account and attend a traditional public or charter school full-time, though they can purchase public school services, including public school classes in some states. Some account laws allow families to save unused funds from year to year and prepare for college expenses.

New Hampshire already allows students from families with incomes at or below 300 percent of the poverty line (approximately $72,000 for a family of four) to apply for private school scholarships, but the accounts would provide students with more options than just a private school. Parents can customize their child’s education with multiple learning services at the same time.

Families in Arizona are using accounts to hire a tutor and pay for education therapists. Some Florida families are buying textbooks and other curricular materials to educate their children at home. More than 12,500 students are using the accounts across the country.

Under the New Hampshire proposal, and similar to laws enacted in other states, 95 percent of an eligible child’s funds from the state formula would be available to students in an education savings account (approximately $3,600).

Changes to the bill in December made children with special needs and low-income students eligible to apply, along with students who were denied a private-school scholarship or charter school enrollment due to space limitations.

But district school supporters have criticized the proposal, claiming the accounts will put children with special needs at a “disadvantage relative to their peers” and take money from public schools.

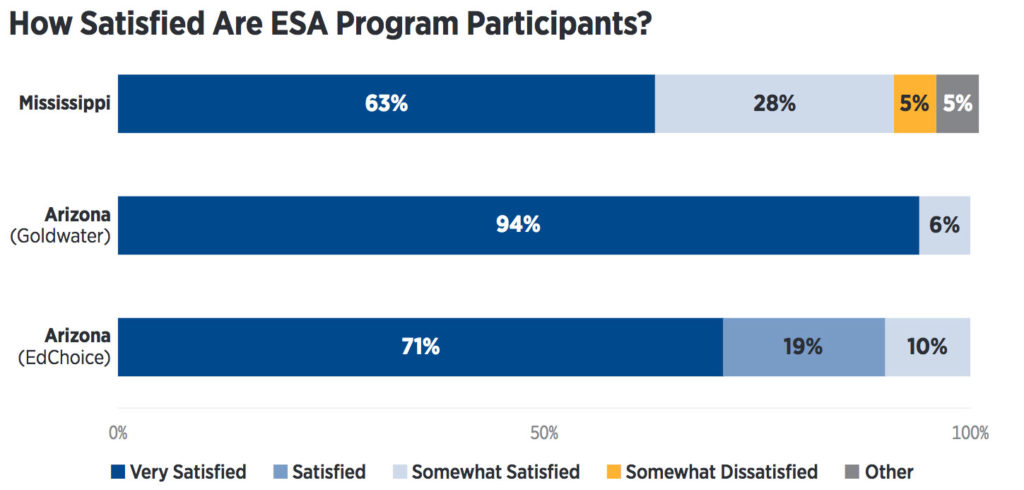

Yet research from other states with account laws finds high levels of parent satisfaction among families of children with special needs.

(Photo: The Heritage Foundation.)

Furthermore, the legislature appears to be ready to give school districts additional money (called “stabilization grants”) when students choose an education savings account. This gives the opposition less to grouse about, and those opposing more educational opportunity should explain to taxpayers why they should fund empty seats in public schools.

Andrew Cline, interim president of the Josiah Bartlett Center, explains that “[e]ven using opponents’ most dire prediction, in which 5 percent of New Hampshire students take advantage of [education savings accounts] to pursue educational opportunities outside of their assigned district, districts hold on to more than 98 percent of their funding.”

New Hampshire taxpayers and policymakers should look to states that already have education savings account laws to find ways to reduce the taxpayers’ burden. For example, according to Arizona legislative analysts, the state’s account laws save taxpayers $1,400 for each child with special needs whose parents choose an account.

Opponents to education savings accounts are trying to prevent children and families from having more opportunities in education—adding bitter political winds to an already snowy New England winter. Instead, lawmakers should continue to push for ways to give more children the chance to succeed.

This piece originally appeared in The Daily Signal