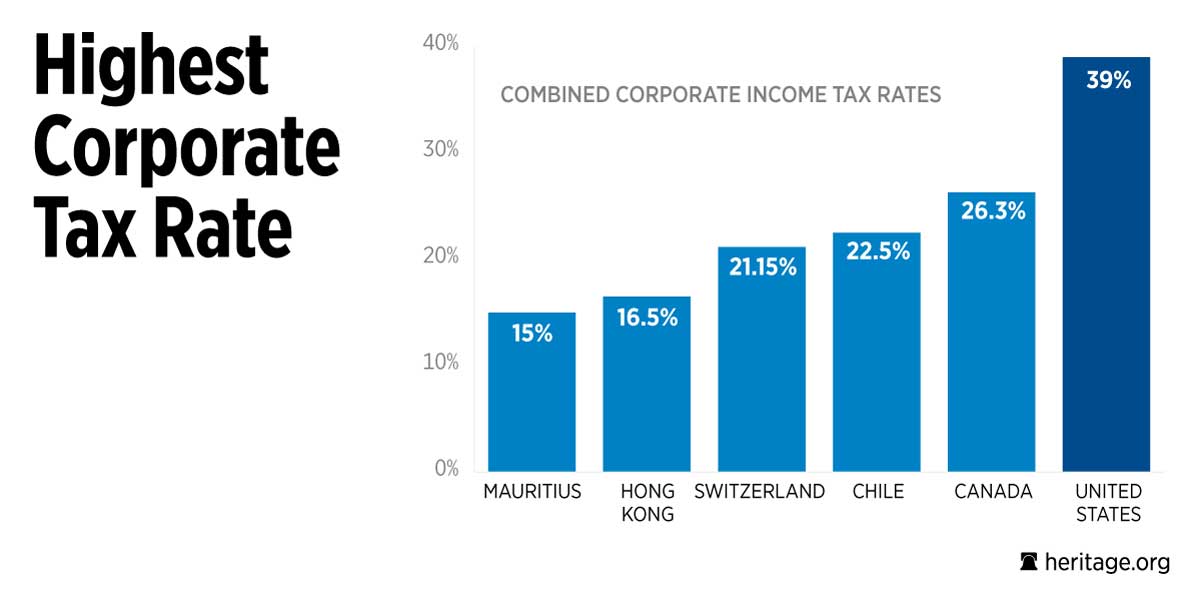

Countries around the world have made maintaining low corporate tax rates, as well as reducing rates, a priority in recent years. Meanwhile, the United States has stood on the sidelines.

As a result, the U.S. now has the highest corporate tax rate in the developed world, exceeding the Organization for Economic Cooperation and Development average by nearly 15 percentage points. By maintaining such a high corporate tax rate, the United States hinders its competitiveness in the global economy.

(Chart: John Fleming/The Heritage Foundation)

>>> For this and other charts about the federal budget, visit Federal Budget in Pictures

In 1993, the U.S. corporate tax rate was increased from 34 to 35 percent, where it has remained since. Corporations in the U.S. also are subject to state and local taxes, resulting in a combined average corporate tax rate of 39 percent.

In contrast, Estonia, for example, has decreased its corporate tax rate by 6 percentage points since 2005. Hong Kong has a simple and efficient tax system, and a top corporate tax rate of only 16.5 percent.

According to Curtis S. Dubay and David R. Burton, research fellow and senior fellow at The Heritage Foundation, respectively, the current business tax system is “slowing investment, which depresses economic growth, slows job creation, and suppresses wages.”

These problems are reflected in Heritage’s 2016 Index of Economic Freedom, where the U.S. is ranked 154th out of 178 countries in fiscal freedom.

In June, House Republicans released a blueprint for tax reform, which included proposals to change the way the government taxes corporations and other businesses. Reforms clearly are needed.

In the end, reforming the corporate tax rate is about making America a place where domestic and foreign businesses can invest, grow, and prosper while supporting jobs right here at home.

This piece orginally appeared in The Daily Signal