Where will President Joe Biden and congressional Democrats get the money to finance their large expansion of subsidies for green energy and extension of Obamacare subsidies for the upper middle class?

The simple answer is: “From hardworking taxpayers.”

Taxpayers across the income spectrum should expect they ultimately will pay for the left’s deceptively named “Inflation Reduction Act.”

But the new taxes would fall more heavily across specific industries and parts of the country. The largest tax in the bill, the new “book minimum tax,” accounts for $222 billion of the more than half a trillion dollars of expected new tax collections. The book minimum tax would hit manufacturing disproportionately.

According to recent government estimates by the Joint Committee on Taxation, manufacturing would bear 49.7% of the book minimum tax, despite accounting for only about 11% of the economy.

More specifically, the nonpartisan committee estimated that 16.1% of the tax would fall on chemical manufacturers and 6.9% on transportation equipment (mostly automobile) manufacturers.

Since the committee released those estimates, Senate amendments to the legislation likely have reduced manufacturing’s share of the tax somewhat. However, even using a conservative estimate, manufacturing likely still would bear at least 2.5 times as much of the burden of the tax, relative to the sector’s size as a share of the economy.

Foreign manufacturers would not be subject to the new tax unless they have significant U.S. operations. Therefore, to remain globally competitive, U.S. manufacturers would face pressure to cut labor costs or scale back their U.S. operations. This would mean fewer jobs and lower wages in U.S. manufacturing.

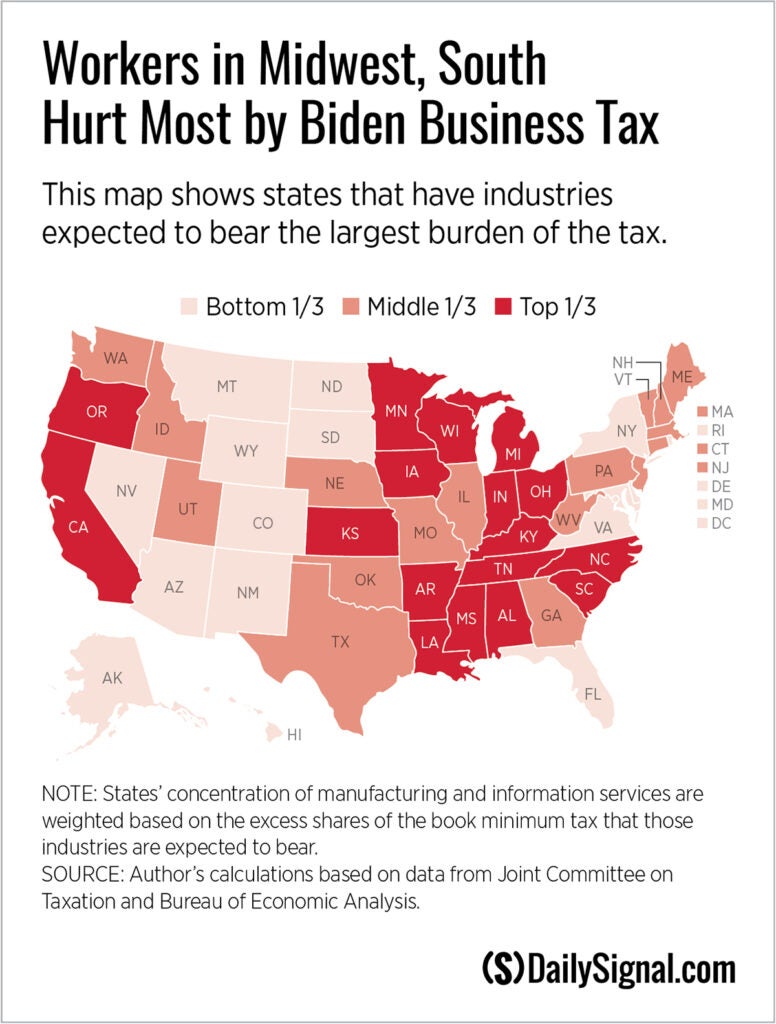

Due to their states’ large manufacturing bases, workers in Indiana, Wisconsin, Michigan, North Carolina, and Kentucky would endure the biggest economic hit from the new tax. Manufacturing accounts for about 26.6%, 18.9%, 18%, 17.1%, and 17.4% of the economies of these five states, respectively.

Employment in U.S. manufacturing dropped by about 33% between 2000 and 2010. Since then, manufacturing’s steep decline has reversed slightly, but manufacturing jobs remain more than 25% below 2000 levels.

Indiana, Wisconsin, Michigan, North Carolina, and Kentucky combined have lost over 1 million manufacturing jobs since 2000. Largely because of deep losses of manufacturing jobs, total private sector employment in Indiana, Wisconsin, and Michigan fell 7.5% in this period.

A new tax won’t help America’s manufacturing states.

The proposed book minimum tax is a parallel tax system imposed on mostly larger companies based on their financial statements’ “book income.”

Business taxpayers would have to calculate their tax liability not once, but twice. First, based on their regular taxable income and second, based on financial statement income—and they’d pay the higher liability of the two.

The book minimum tax would be at a lower rate (15%) than the federal corporate tax rate, but the book minimum tax would not allow businesses to claim certain business deductions allowed under the normal corporate tax.

Because of its income threshold, the book minimum tax disproportionately would hit capital-intensive sectors such as manufacturing, where large-scale operations often are necessary to achieve the economies of scale needed to compete in a global economy.

Differences between financial statement accounting and regular tax accounting in the timing of the “realization” of income and when deductions could be claimed also would cause business taxpayers to arbitrarily owe the book minimum tax in some years.

As just one example, under the book income tax, companies would not be able to use net operating losses accrued before 2020. There are, of course, many reasons that companies experience tax losses in a particular year—including anything from high initial startup costs to pandemic-related government lockdowns. And so the tax code allows taxpayers to carry forward losses from previous years to offset current taxable profits.

Consider a company whose purchase of costly factory equipment in 2018 and 2019 pushed it into a taxable loss for those years. That company would hope to offset the cost of that investment eventually with higher profits in subsequent years.

COVID-19 shutdowns may have delayed those future profits, and now under Biden’s book minimum tax, the company could have to start paying tax even if it is still at a net loss since its 2018-2019 investment.

Many manufacturers expanded investment in 2018 and 2019 specifically because of federal tax legislation that removed impediments to business investments. The full expensing provisions of the 2017 Tax Cuts and Jobs Act allowed businesses to fully deduct expenses for things such as machines and equipment in the year capital was purchased and placed in service, instead of over a period that could last for two decades.

Or at least these manufacturers thought they’d be able to fully deduct those expenses.

With Biden’s book minimum tax, Uncle Sam would snatch away a portion of the deduction for capital expenses incurred by companies with unused net operating losses.

The timing of the new tax is unfortunate. The looming phaseout of full expensing between 2023 and 2027 only will worsen the U.S. tax environment for capital-intensive businesses such as manufacturers and conventional energy companies. Rising interest rates and borrowing costs also will make it more difficult for manufacturers and other businesses to invest and grow.

It’s not all bad news for manufacturers, though. Although many manufacturers would be hammered with new taxes under the Biden legislation, companies manufacturing components for solar panels, wind turbines, batteries, and electric vehicles would receive a windfall of new tax subsidies and access to dramatically expanded federal loan programs courtesy of the “Inflation Reduction Act,” their industry’s Washington lobbyists, and ultimately your wallet.

It’s long past time for the federal government to get out of the business of picking winners and losers. Over the past couple of years, success or failure in America has depended far too much on what the government is doing foryou or what it’s doing against you.

Sadly, this latest legislation is more of the same. More government handouts for some. More taxes, lost jobs, lower wages, and more IRS audits for the rest.

This piece originally appeared in The Daily Signal