April 18, 2018 Building on Reform through Tax Reform 2.0

Following the most sweeping update to the U.S. tax code in more than 30 years, Americans are no longer suffering under its most burdensome features.

Wednesday, Apr 18, 2018

11:00 a.m. - 12:00 p.m.

The Heritage Foundation

Followed by a Discussion with

Hosted by

Description

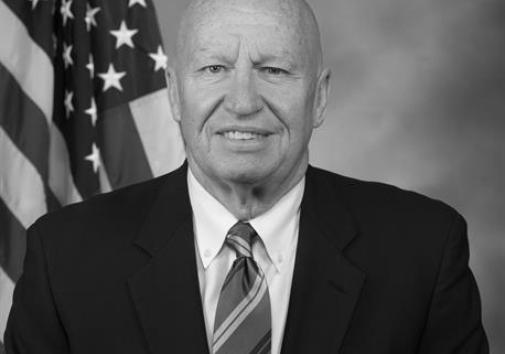

Following the most sweeping update to the U.S. tax code in more than 30 years, Americans are no longer suffering under its most burdensome features. The Tax Cuts and Jobs Act of 2017 (TCJA) simplified the tax paying process for many Americans, lowered rates on individuals and businesses, and updated the business tax code to jumpstart America’s global competitiveness. Unfortunately, in 2025, most individual and some business tax cuts will revert to pre-reform levels. To prevent this from happening Congress has an opportunity to revisit the tax code to make their reforms permanent. Join us for a discussion with Chairman Kevin Brady and a panel of experts on what the next phase of tax reform might look like.

COMMENTARY 3 min read

COMMENTARY 3 min read

BACKGROUNDER 29 min read