Testimony Before The Subcommittee on Health Care and Financial Services

Committee on Oversight and Government Reform

United States House of Representatives

February 11, 2025

Robert Rector

Senior Research Fellow

The Heritage Foundation

My name is Robert Rector. I am a Senior Research Fellow at The Heritage Foundation. The views I express in this testimony are my own and should not be construed as representing any official position of The Heritage Foundation.

Introduction

Marriage is an institution of utmost social importance. Marriage is the foundation of civil society. For more than a half century the welfare state has waged war on marriage. This assault occurs for two reasons: first, the welfare state is focused overwhelmingly on subsidizing single parent families. Second, all welfare benefits are designed so that they are cut sharply when lower income parents marry.

In consequence, nearly all lower income parents are caught in a trap of perverse incentives losing substantial economic resources if they tie the marital knot. In effect the welfare state has made marriage economically irrational for most low and moderate income families. Over time, welfare’s perverse incentives have altered social norms and expectations, pushing fathers out of the home. Caught in a trap of dysfunctional anti-marriage penalties, millions of mothers have ended up marrying the welfare state rather than the fathers of their children.

Welfare has led to a sharp decline in marriage in the U.S. When Lyndon Johnson launched the War on Poverty, 7 percent of American children were born outside marriage. Today the number is over 40 percent.

Welfare reform in the 1990’s mitigated some of the anti-marriage effects of welfare. Following reform, decline in marriage among families with children halted. Non-marital pregnancy, birth and abortion rates fell, particularly among teens. The poverty rate of single parent families has fallen substantially. Finally, the changes initiated and promoted by welfare reform have led to 9.8 million fewer non-marital abortions.REF

The principles of welfare reform should be reanimated. Marriage penalties within the welfare state should be substantially reduced and work requirements in welfare should be strengthened. Policy makers should recognize that welfare work requirements and marriage promotion are linked. One of the main lessons of welfare reform is that work requirements reduce the utility of being a single mother on welfare; in response, mothers increasingly turn to rely on marriage and fathers.

The Social and Personal Benefits of Marriage

Marriage is a vital and essential social institution. Marriage generates manifold social, psychological, and economic benefits. Marriage serves as an all-purpose antibody protecting against a broad array of social problems while positively enhancing personal and social well-being. For example, marriage dramatically reduces poverty, dramatically drops child sexual abuse, lowers suicide rates, decreases drug abuse, increases educational attainment, raises wages, improves physical and mental health, and increases longevity.

A healthy marriage is one of the two most important factors contributing to personal happiness. Marriage is also a very strong factor in promoting the upward mobility of children. The erosion of marriage has a marked effect on the violent crime rate in communities. Holding race, poverty, and other background variables constant, a one percentage point increase in the share of households in the community that are married is associated with a 2 percent decline in violent crime per capita.REF

Strong and widespread marriage also boosts overall growth in the economy. This important connection has been investigated by researchers Brad Wilcox, and Robert Lerman. Comparing economic growth between U.S. states, they found that states with greater declines in the number of intact families (measured by the percent of parents living in two-parent families) had slower growth across their entire economies. In other words, declining marriage impedes general economic growth.

The research by Wilcox and Lerman shows that for every 2 percent decline in the share of parents residing in two-parent families, there was roughly a 1 percent decline in gross domestic product (GDP) per capita across the whole state population.REF Extrapolating these figures for the U.S. economy as a whole would mean that the decline in two-parent families over the past half-century would have resulted in a reduction of around 5.5 percent in annual GDP in 2021. This amounts to a loss of $1.3 trillion or around $3,800 per capita in 2021 alone. Over a decade, the economic loss comes to $13 trillion.

Finally marriage substantially reduces abortions and raises the birth rate while improving life outcomes for the children born.

Welfare Harms Marriage

When President Lyndon Johnson launched the War on Poverty in 1965, he said that its purpose was to strike “at the causes, not just the consequences of poverty.” He added, “Our aim is not only to relieve the symptom of poverty, but to cure it and, above all, to prevent it.”

In fact, the actual War on Poverty policies had the opposite effect, with devastating consequences for lower income families. Dramatically increasing government spending and creating an ever-growing number of new welfare programs, the War on Poverty produced a rapid decline in married, two parent families, a steady growth in non-marital birth rates, a rise in abortions, and the spread of long-term government dependence.

Crucial steps were taken to reverse these negative trends with the enactment of welfare reform in 1996. Welfare reform replaced a central, failed welfare program called Aid to Families with Dependent Children (AFDC) with a new program: Temporary Assistance to Needy Families (TANF). In contrast, to other welfare programs, the new TANF program established work requirements and time limits on benefits for recipients. In addition, under the new program, state governments that wished to expand dependence and welfare spending would be required to finance that expansion with state, rather than federal, funds. Even blue states were reluctant to spend their own funds in that manner.

Around 90% of recipients in the AFDC and TANF programs were single parents. The welfare reform law had the explicit goal of reducing out-of-wedlock births; and promoting marriage. The new work requirements and time limits were implicitly aimed at strengthening marriage by reducing the economic utility of single parenthood and non-marital births relative to marriage. This policy was successful in arresting the rapid decline in marriage which occurredin the decades before reform. Now, it is time for a fresh round of new policies to rebuild and expand the vital institution of marriage.

The Means-tested Welfare State

A means-tested benefit is available only to lower income persons and not to the general public. For example, food stamps are means-tested whereas public schools and highways are not. The means-tested welfare system has nearly 90 separate programs that provide cash, food and housing benefits; medical aid: and a small amount to targeted social services.REF Major means-tested programs include: Temporary Assistance to Needy Families, the Earned Income Tax Credit, Supplemental Security Income, the Additional Child Tax Credit, Food Stamps, Women Infants and Children Food Program (WIC), School Nutrition programs, Medicaid, the Community Health Center program, the Child Health Insurance Program (CHIP), Public Housing and Section 8 Housing.

The welfare state is enormous. In 2018, before the COVID epidemic, federal and state governments spent nearly $1.2 trillion per year on means-tested aid programs. Of this, 47 percent or $564 billion was spent on means-tested aid for lower income families with children, predominately directed at on single parents. This amounts to $47,000 per family distributed evenly within the lowest income third all families with children. The figure would be much higher in 2024.

Main Problems with the Existing Welfare System

Welfare reform in the 1990’s overhauled the AFDC program, a primary program supporting families with children. This overhaul mitigated some of the worst aspects of traditional welfare; on the other hand, all the remaining welfare programs remained almost entirely unchanged. This means that the welfare system as a whole remains dysfunctional.

In particular, the means-tested welfare and support system for poor and lower income families with children has four major ongoing problems:

-

Anti-marriage bias. Nearly all the cash, food and housing programs within the system focus on subsidizing non-married single parent families with the greatest benefits targeted at families that do not work. Moreover, all the programs discriminate against marriage by imposing substantial financial penalties on parents who choose to marry. The welfare system has made marriage economically irrational for many low income couples. The system displaces fathers, driving them away from the home. This anti-marriage bias is ironic given that marriage is one of the most effective paths out of poverty and dependence. In addition, marriage in itself has a profound effect in improving the well-being of adults, children and society. The anti-marriage bias of the welfare system is harmful to families and society.

-

Supporting idleness, undermining work. Along with marriage, work is a critical path out of poverty. Work and self-support are critical factors in promoting personal well-being. Moreover, welfare reform in the 1990’s showed that requiring work from single parents had a strong positive effect on strengthening marriage and decreasing single parent families. Although the welfare system has been nominally pro-work since welfare reform in the 1990’s, most welfare programs do not have significant work requirements. Even programs that have work requirements such as Temporary Assistance to Needy Families (TANF) and the Earned Income Tax Credit (EITC) have loop holes that allow many recipients to evade the requirement. Even worse, liberals consistently push to remove work requirements and restore unconditional work-free welfare to single parents.

-

Concealing the magnitude of welfare spending and benefits. Most lower income families receive benefits from several programs simultaneously. But the press and decision makers invariably perceive and discuss the welfare system one program at a time. This problem is exacerbated by the Congressional sub-committee system which ensures that each program is examined in isolation and the overarching multi-program context is never examined. Current political discourse on welfare is like taking the jumbled pieces of a jigsaw puzzle and examining each piece individually but never putting the pieces together to see the whole picture. Fragmenting the welfare system and presenting each program in isolation invariably makes the welfare system seem far smaller than it actually is.

To make matters worse, the official government’s official poverty report, issued annually by the Census Bureau, ignores almost the entire welfare system when determining is a family is poor. Programs that are deliberately excluded from this report include: cash grants from the EITC and refundable child credits (ACTC)REF; all food stamp benefits,; WIC benefits, child nutrition aid, Section 8 housing vouchers, public housing aid, energy assistance, Medicaid, and the Children’s Health Insurance Program (CHIP) and all Affordable Care Act subsidies. In the two means-tested cash aid programs that are included (Supplemental Security Income (SSI) and TANF, benefits are consistently under-reported. When it comes to defining and measuring poverty, incomes, and inequality, the government’s official poverty report treats nearly the entire means-tested welfare system as non-existent and “off the books”. In 2018, out of a total of $527.5 billion spent on means-tested benefits for families with children, Census counted only $14.1 billion (or 2.5 percent) as “income” for purposes of its official poverty measurement.

-

Generating an implicit bias toward increasing spending and benefits. Piecemeal analysis of the welfare system focusing on each of the 90 programs invariably generates impression is that the U.S. has a Spartan welfare system and that poverty and material deprivation are wide-spread and severe. This erroneous perception of a meager welfare state, in turn, fuels endless demands from the left to expand welfare benefits and spending.

The underlying perception, however, is completely inaccurate; in reality, in 2018 the average family with children identified as “poor” by the government received around $21,000 in cash, food and housing aid and another $17,000 in medical benefits. When these benefits were combined with family earnings, the total resources available to the family rose to around $55,000 per year.

How Welfare Harms Marriage

Most Americans believe that marriage should be strengthened, not weakened. One obvious way to strengthen marriage is to remove governmental financial penalties against marriage. Most conservative policymakers view marriage penalties as occurring mainly in the federal income tax. Thus, marriage penalties are seen incorrectly as primarily affecting the top half of the income distribution: those who actively pay income taxes. In reality, marriage penalties in the basic federal income tax code, to the extent they exist, are comparatively small and at worst affect only a small portion of the income of married parents.

The really significant marriage penalties in U.S. society occur in the more than 40 means-tested welfare programs that affect lower-income families with children. These programs, which include food stamps, WIC, the EITC, SSI, and Section 8 housing among many others, provide cash, food, housing, medical care, and social services to approximately the lowest-income 40 percent of families with children: those with incomes below $80,000 per year.

Welfare marriage penalties exist because welfare benefits are based on the joint income within a household. The welfare state operates like the income tax would if it lacked the category of “married filing jointly”.

If a single mother marries an employed father, the family’s measured joint income will rise sharply; the earnings of the father will be applied to the mother’s welfare eligibility, and benefits will be cut sharply or eliminated entirely. This creates a considerable financial incentive not to marry. All welfare programs have substantial marriage penalties that, in the aggregate, can represent a large share of the parents’ total economic resources. The threat of loss of a comparatively large pool of assistance can provide a substantial disincentive for parental marriage.

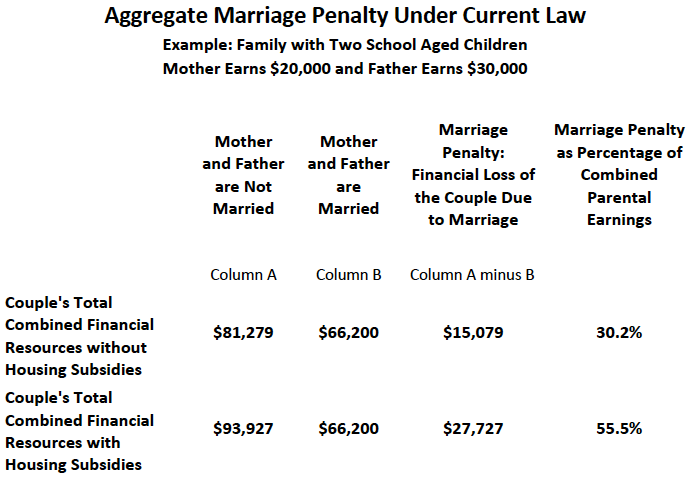

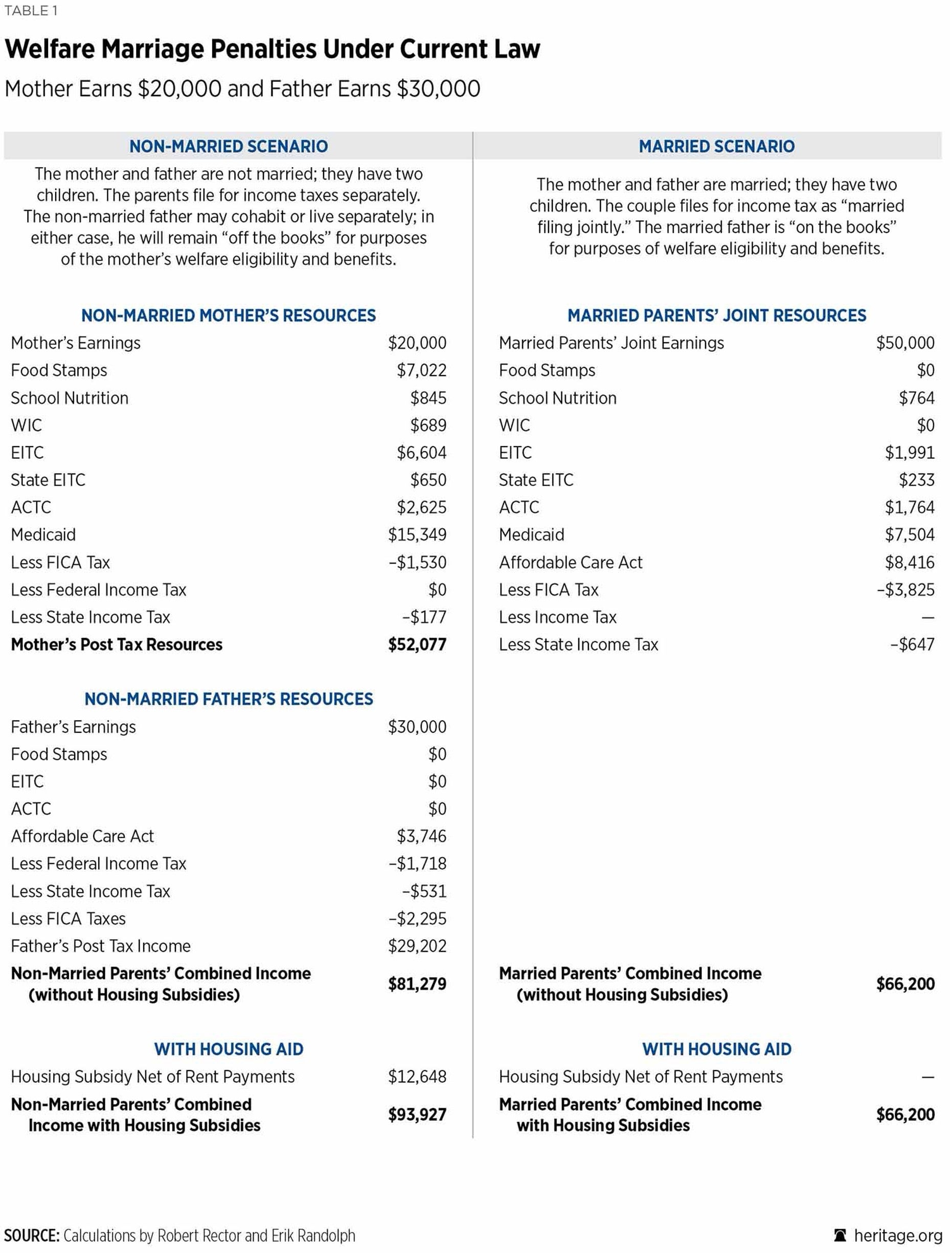

For example, take the case of single mother with two children: one school aged and one younger. (See table 1 and table 2 at the end of the testimony.) The mother has annual earnings of $20,000, and the father of the children has annual earnings of $30,000. The parents are not married. The father may live separately or he may cohabit with the mother and children; in either case, his presence and income would not generally be reported to the welfare agencies; he would remain “off the books” for purposes of determining the welfare benefits received by the mother.REF

The mother, in the example, would receive $7,022 in food stamp benefits, $845 in school nutrition subsidies, $689 in WIC benefits, $6,604 in federal EITC cash benefits, $650 in state EITC, and $2,625 ACTC cash benefits.REF The family would also receive Medicaid with an average value of $15,349. The total resources of the single mother including post tax earnings, cash, food and medical benefits would come to $52,077. This is more than twice the official poverty level for the family.

The father would pay FICA taxes and federal and state income tax on his $30,000 in earnings but would also be eligible for health care subsidy from the Affordable Care Act (Obama care) of $3746. His total resources would be $29,202. The combined resources of the mother and father would be $81,279.

If the mother married the father, the father’s earnings would be “on the books” and would be used to determine the family’s overall welfare benefits. Food stamp benefits would be eliminated, other benefits would generally be cut or eliminated. On the other hand, the father would no longer pay federal income tax. Altogether, the effect would be strongly negative: marriage would cut the parents’ combined resources from $$81,279 to $66,200. The effective marriage penalty would be $15,709 or 30 percent of the parents’ combined pre-tax earnings.

Current Loop Holes in the Work Requirements for the EITC and ACTC

Work requirements can have a strong pro- marriage and anti-poverty effects. But very few welfare programs have work requirements. Within the welfare state, the Temporary Assistance to Needy Families, the EITC and the ACTC have nominal work requirements. Yet, loopholes greatly weaken these requirements. Under current law, parents are ostensibly required to work to obtain EITC or ACTC cash benefits. However, this work requirement is highly porous and can be readily evaded.

Under the law, many persons besides the parent are legally permitted to claim the child as a dependent on their tax return and receive cash from both the EITC and ACTC for the child based on their reported earnings. Potential legal claimants include: the custodial parent or married couple, non-married, non-custodial parents, maternal grandparents, paternal grandparents, aunts, uncles, spouses of aunts and uncles (if filing jointly), adult sisters or brothers, step-parents, step grandparents, step aunts and uncles, adult step-brothers and sisters.REF

Legally, any filer claiming a child is supposed to reside with that child for at least half the year, but this requirement is not enforced at all. A single parent with no earnings will typically have at least a dozen persons (counting absent non-married parents, grandparents, aunts and uncles and their spouses) and often as many as two dozen persons with de facto eligibility to claim a child on their tax returns. In almost all cases, a non-working single parent will have no difficulty finding many persons with earnings who can claim each child. The trick is to find potential filers with earnings low enough to maximize EITC and ACTC cash benefits.

Often, single mothers who do not work, or work only a little, will transfer the work obligation and eligibility for the EITC and ACTC to the child’s non-married cohabiting or absent father. Usually, this individual has never married the mother. If the non-working single parent does not transfer eligibility to a cohabiting or absent father, she will typically transfer eligibility to one of the innumerable relatives listed above, very often this individual will not live with the child.

After the work obligation and benefit eligibility has been transferred to an alternate tax filer, the transferred EITC and cash ACTC benefits will be shared between the non-working custodial parent and the surrogate tax filer. Altogether, in 2022, at least, one out five single parents (or 2.8 million individuals) receiving EITC benefits were likely to receive them indirectly through labor surrogates. Clearly, a work requirement that can be easily “transferred” to up to two dozen other people is not a serious requirement; it provides little incentive or obligation to work to the recipient parent.

Pervasive Fraud in the EITC, ACTC and Other Welfare Programs

But weak work requirements are not the only problem in the EITC and ACTC. At least a third of EITC payments are fraudulent or “erroneous”. The actual error rate may be higher; one sophisticated study suggests that nearly half of EITC benefits to go ineligible tax filers.REF These problems are not unique to the EITC. The EITC is known to have high error rates because the IRS meticulously audits the program. Other programs such as food stamps and housing benefits are likely to have similar error rates, but those rates are not known because the programs are laxly audited.

While the IRS conducts excellent audits of the EITC and ACTC using small scientific samples, it makes no effort to actually stop the massive misuse of funds its sample audits reveal. The most common types of fraud are: false earnings claims, false claims of residence and false claims of relationship with the claimed child. Such fraudulent claims can be readily stopped but neither Congress nor the executive branch make any effort to stop them.

Reforming Welfare

The welfare system, and specifically the EITC and ACTC programs, should be reformed to:

- Strengthen marriage in society by reducing the extensive and severe financial penalties against marriage that are omnipresent in the federally funded welfare state;

- Strengthen work requirements in the EITC and other welfare programs to reduce unnecessary dependence;

- Eliminate or sharply reduce fraud and “erroneous payments” in the EITC and other programs;

- Reduce unnecessary and excessive benefit spending in welfare, particularly the excess that occurs when very expensive housing benefits are piled on top of other benefits;

- Create a new database on actual benefits and beneficiaries in federally funded welfare programs by integrating existing state administrative program data; this database be used to prevent fraud, identify waste, and provide accurate data on financial resources in low income households, poverty and inequality.

The centerpiece of reform should be to offset welfare marriage penalties by increasing the EITC for married couples for children. This effort should be budget neutral; the cost of higher benefits for married couples should be funding by spending reductions created by eliminating fraud, cutting waste and excess, and reducing caseloads through work requirements.

The five principles above will operate synergistically. Strengthening work requirements, reducing fraud and excessive benefits, reducing marriage penalties by increasing benefits to married parents relative to those who are not married, will all strengthen marriage.

Tragically, welfare effectively operates as a rival and alternative to marriage with a child’s father. The six reform principles all work to reduce the utility of being a single mother on welfare relative to being married to the father of your children. By undermining marriage, welfare harms mothers, fathers, children and society at large. It is time to defend marriage against the depredations of the welfare state.

******************

The Heritage Foundation is a public policy, research, and educational organization recognized as exempt under section 501(c)(3) of the Internal Revenue Code. It is privately supported and receives no funds from any government at any level, nor does it perform any government or other contract work.

The Heritage Foundation is the most broadly supported think tank in the United States. During 2023, it had hundreds of thousands of individual, foundation, and corporate supporters representing every state in the U.S. Its 2023 operating income came from the following sources:

Individuals 82%

Foundations 14%

Corporations 1%

Program revenue and other income 3%

The top five corporate givers provided The Heritage Foundation with 1% of its 2023 income. The Heritage Foundation’s books are audited annually by the national accounting firm of RSM US, LLP.

Members of The Heritage Foundation staff testify as individuals discussing their own independent research. The views expressed are their own and do not reflect an institutional position of The Heritage Foundation or its board of trustees.