The Institute for Economic Freedom

Hailed as “an economist who speaks English,” Romina Boccia has mastered federal budget minutiae—and the ins and outs of the budgeting process—like few others.

Shrink the Budget; Grow the Economy

Though born and raised in Augsburg, Germany, Romina Boccia today is often introduced as “an economist who speaks English.” That’s because she has a talent rare among practitioners of “the dismal science”: the ability to explain complex, number-heavy subjects in an engaging and understandable style.

That skill—combined with her keenly analytic mind—has made her highly sought after as both a guest TV commentator and an expert witness at congressional hearings. It also made her the logical choice to take the reins of Heritage’s newest research center, the Grover M. Hermann Center for the Federal Budget, located within our Roe Institute for Economic Policy Studies.

“The federal budget is fast approaching critical mass,” noted Roe Institute Director Paul Winfree during the launch of the new center. “If Congress fails to curb its seemingly insatiable appetite for spending, we will soon find ourselves in a fiscal crisis that stifles growth and lowers living standards.”

The Hermann Center will showcase the innovative work of Heritage’s budget and tax analysts. “The goal is simple,” said Winfree, a former director of budget policy at the Trump White House. “To keep government spending and taxation in check and aligned with its constitutional duties.”

Institute for Economic Freedom 2018 Highlights

Senior Research Fellow Diane Katz

Herbert and Joyce Morgan Fellow Nick Loris

Walter Williams

Lighting the Path to Fiscal Responsibility

One of the center’s first publications was “Blueprint for Balance: A Federal Budget for FY 2019.” As Boccia noted in the preface: The size and scope of the federal budget “affects every aspect of governance and its relationship to the American people … [directly affecting] Americans’ ability to provide for their families, contribute to their communities, and pursue their version of the American dream.”

The Blueprint offered lawmakers specific, actionable guidance that would reduce spending by more than $12.3 trillion over 10 years and eliminate deficits by 2025—all while meeting America’s need to rebuild its military and keep Social Security solvent.

To help those lawmakers truly interested in exercising fiscal responsibility, Winfree and Boccia followed up the Blueprint by forming the Budget “Shadow” Committee. A group of 15 experts from conservative and centrist think tanks, the Shadow Committee meets monthly, producing a series of commonsense recommendations for the Joint Select Committee on Budget and Appropriations Process Reform.

Heritage’s cost-saving influence on the administration had been displayed twice earlier in the year.

When President Trump released his transportation agenda in February, it differed markedly from his original proposal to plow $1.5 trillion in federal funds into new infrastructure projects. Rather than add that much to the national debt, the final proposal called for using just $200 billion in federal funds over 10 years to leverage $1.3 trillion in funding from cities, states, and private investors.

This tracked closely with Heritage’s recommendations, as did the plan’s call for states to cover up to 80 percent of project costs—a reversal of the long-standing funding formula.

At mid-year, the Roe Institute celebrated another policy victory when its paper laying out the compelling economic arguments against bailing out non-competitive coal and nuclear power plants helped persuade the White House to drop the plan.

During the White House event marking the six-month anniversary of the landmark 2017 tax cuts, President Trump personally thanked Heritage for shaping tax reform.

Fighting to Preserve Pro-Growth Tax Reforms

The 2017 tax reforms helped to grow and sustain a strong economy in 2018. At a ceremony celebrating the six-month “anniversary” of the landmark tax cuts, President Trump singled out Kay Coles James for special recognition, saying “Your support has been incredible in getting this very difficult legislation to the finish line and passed.”

By year’s end, the pro-growth reforms had helped drop employment to the lowest rate in a half century, boost real wages, and let average households keep $1,400 more of what they earned. Despite these concrete results, the Left did its best to discredit general tax relief as “tax cuts for the rich and for big corporations.”

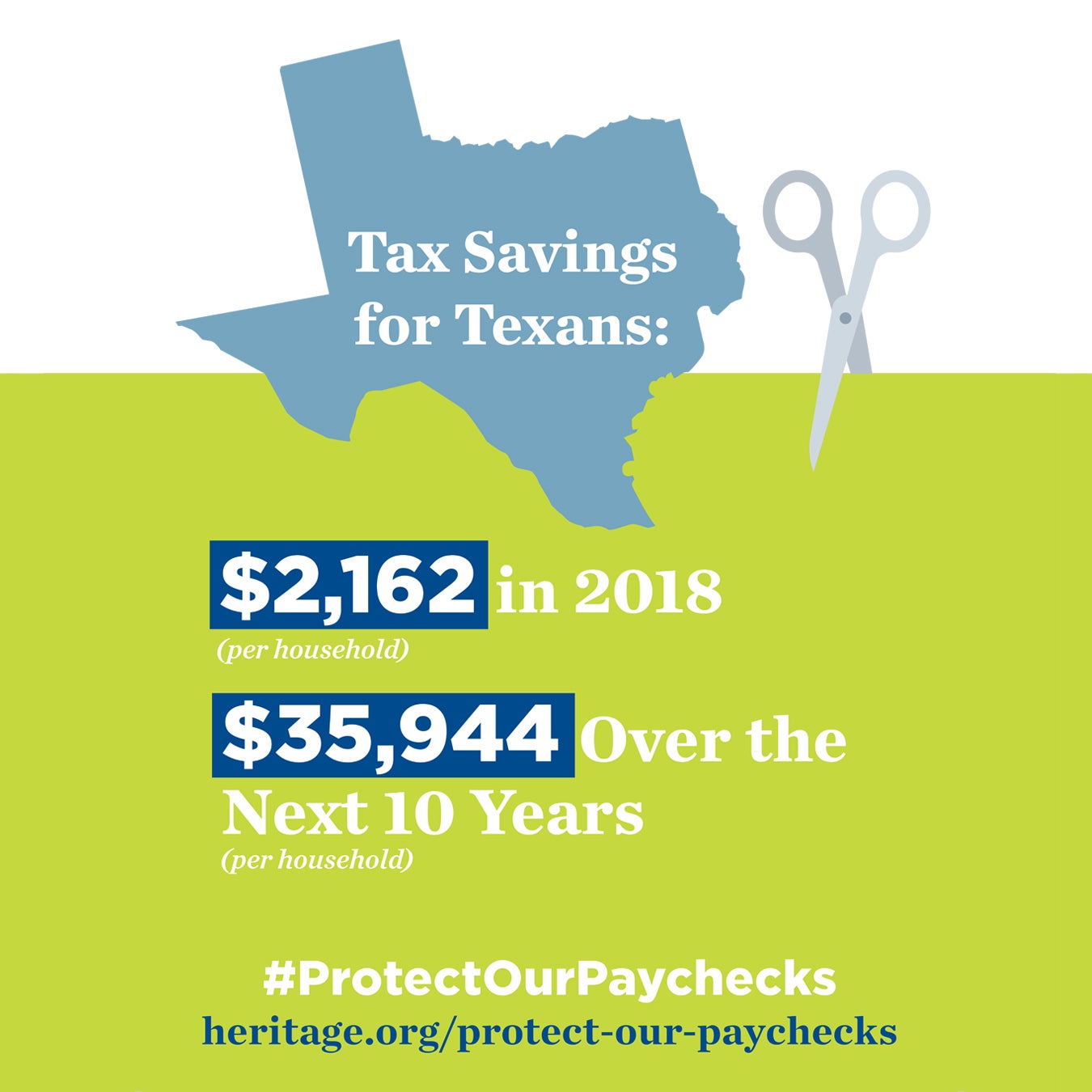

Heritage responded by launching “Protect Our Paychecks,” an enterprise–wide initiative that fought back hard against this false narrative. In every major national print and broadcast news outlet, our experts spread the truth, explaining how lower taxes and the regulatory rollback had sparked business investment and expansion, job creation, and higher wages. Importantly, they stressed that lower income households and minority groups were reaping the greatest gains.

Recognizing that politicians are most interested in how policies “play” among their constituents, our Center for Data Analysis took on a daunting research assignment: develop a sophisticated economic model able to accurately assess how the reforms are affecting typical households in each of the nation’s 435 congressional districts and in every state.

It was a technically complex challenge—one that would have taken other organizations over a year to complete. Our Center for Data Analysis got it done in months.

And the findings were impressive. The model showed that the tax cuts and attendant economic growth will put an additional $26,000 in the average taxpayer’s pocket over the next 10 years. The average family of four will benefit even more—about $45,000 over the course of the decade.

Our communications team then built an interactive “Protect Our Paychecks” website, making the data available to anyone with access to the internet and an interest in seeing how well tax reform is working in any given congressional district and state. In just weeks, the site had garnered more than 100,000 pageviews.

And, of course, we shared that information directly with lawmakers, as well as with the general public via social and traditional media. In all, our analysts briefed 300 members of Congress and their staffs on the model’s findings, published more than 20 op-eds, and gave scores of interviews on radio and TV.

It made a difference. By year’s end, mainstream economists and pundits were widely—and rightly—crediting the tax cuts with fueling the nation’s economic growth.

Rolling Back the Regulatory Tidal Wave

James Gattuso and Diane Katz, two of Heritage’s experts in technology issues, stood firm against Washington’s regulatory impulse to stifle the dynamism of the internet. There is a reason why America has trailed Asian and European nations in deploying the most advanced wireless and broadband technologies, they argued, and a large part of it can be traced to government interference.

June 11 was a banner day for the pair. That’s when the Federal Communications Commission’s repeal of the Obama-era “net neutrality” rules took effect.

Another Roe Institute scholar, Senior Fellow David Burton spent much of the year working to break down regulatory barriers that make it difficult for smaller, younger firms to make private stock offerings or borrow money.

He pled his case personally with the chairman, commissioners, and staff of the Securities and Exchange Commission (SEC), and briefed numerous members of Congress on the advantages of easing restrictions on who may invest in private offerings.

Policymakers listened. The SEC has issued a “concept release” of proposed amendments to do just that and is soliciting public comments on their proposals. If finalized, the rule changes would free small businesses of some unnecessary economic shackles, helping the economy soar even higher.

Additional regulatory reforms came in the energy sector. That’s the turf of Nicolas Loris, our Herbert and Joyce Morgan Fellow. In 2018, he led several successful efforts to secure reversals of Obama-era environmental, energy, and water regulation. These included:

- Opening up more territory to offshore drilling;

- Rolling back sky-high (and technically unachievable) fuel efficiency standards for motor vehicles;

- Adopting the EPA’s Affordable Clean Energy Rule, a vastly preferable alternative to the Obama administration’s economically ruinous Clean Power Plan.