Introduction: Blueprint for Balance

Budgeting is an essential act of governing. Everything the federal government does, it does by either taxing or spending. Even regulatory agencies are able to produce and enforce regulation only when Congress funds their activities. As such, budgeting affects every facet of the federal government and its relationship to the American people. The size and scope of America’s budget has a direct impact on how Americans are able to provide for their families, contribute to their communities, and pursue their dreams.

Blueprint for Balance: A Federal Budget for Fiscal Year 2018, provides detailed recommendations for the annual congressional budget. On the most fundamental level, the budget enables Congress to establish a comprehensive governing philosophy. Congress should put the budget on a path to balance, while strengthening national defense and without raising taxes, to enable economic growth to raise living standards—for all Americans.

In order for Americans to achieve better lives, Congress must take steps to allow Americans to build a stronger economy, a stronger society, and a stronger defense. The Heritage Foundation regularly assesses the strength of America’s economy, society, and defense and has found great need for improvement, as reflected in the:

- 2017 Index of Economic Freedom: Promoting Economic Opportunity and Prosperity, ed. by Terry Miller and Anthony B. Kim (Washington: The Heritage Foundation, 2017);

- 2016 Index of Culture and Opportunity: The Social and Economic Trends that Shape America, ed. by Jennifer A. Marshall and Christine Kim (Washington: The Heritage Foundation, 2016); and

- 2017 Index of U.S. Military Strength: Assessing America’s Ability to Provide for the Common Defense, ed. by Dakota L. Wood (Washington: The Heritage Foundation, 2016).

Congressional adoption of the recommendations set forth in this Blueprint would strengthen America’s economy, society, and defense.

A Federal Budget for Fiscal Year 2018

The federal budget should be a reflection of the principles of the American people within the constraints of constitutional government. The budget delineates priorities, clarifies positions on fundamental issues, reflects views on the role of the government, and provides insight into Americans’ moral character. At the most basic level, a budget is a plan to collect and allocate resources. However, a budget should also illustrate a commitment to individual rights as well as to economic freedom and prosperity. As President Ronald Reagan said in 1981:

We’re not cutting the budget simply for the sake of sounder financial management. This is only a first step toward returning power to the States and communities, only a first step in reordering the relationship between citizen and government.

We can make government again responsive to the people by cutting its size and scope and thereby ensuring that its legitimate functions are performed efficiently and justly.[REF]

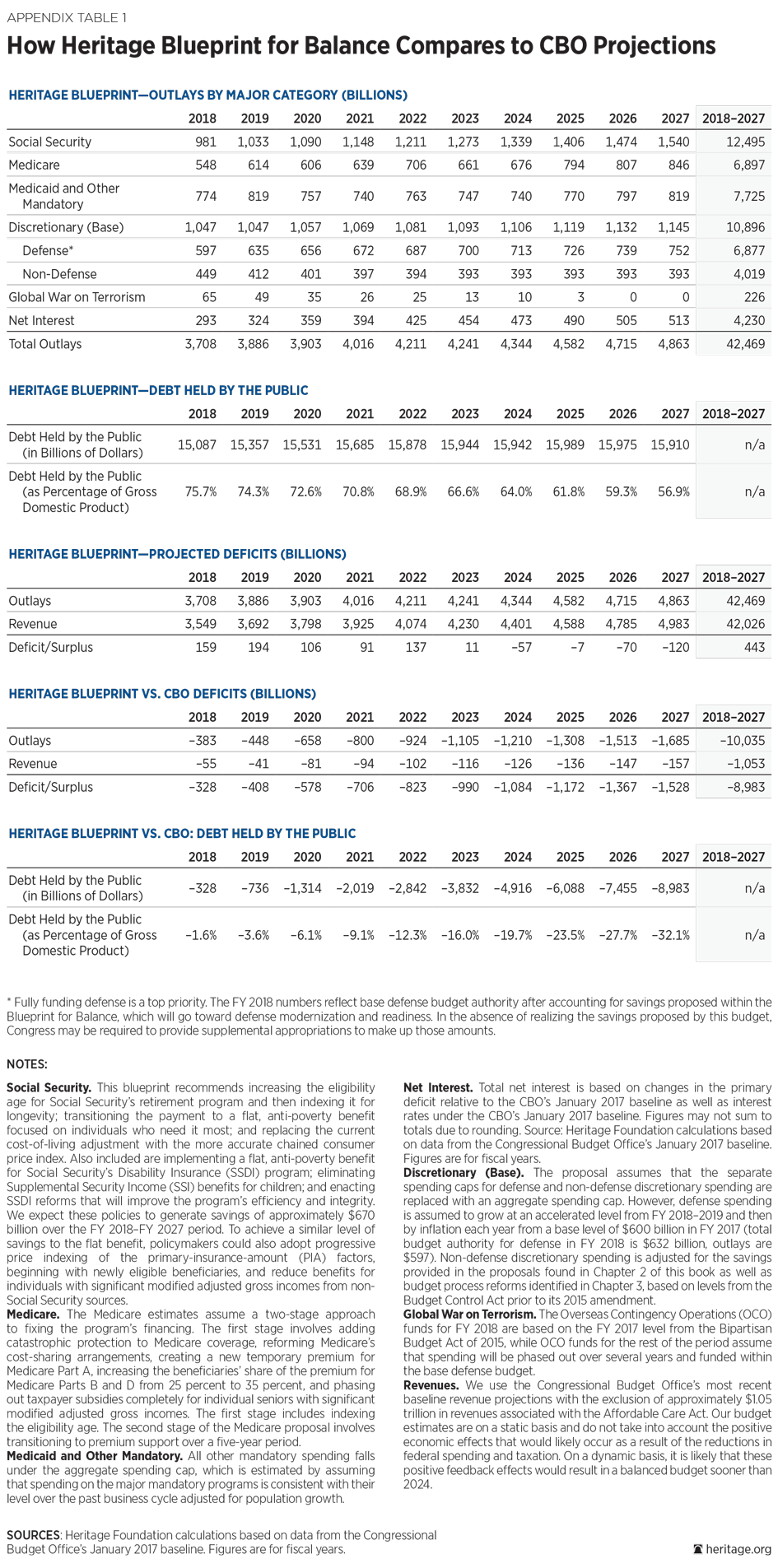

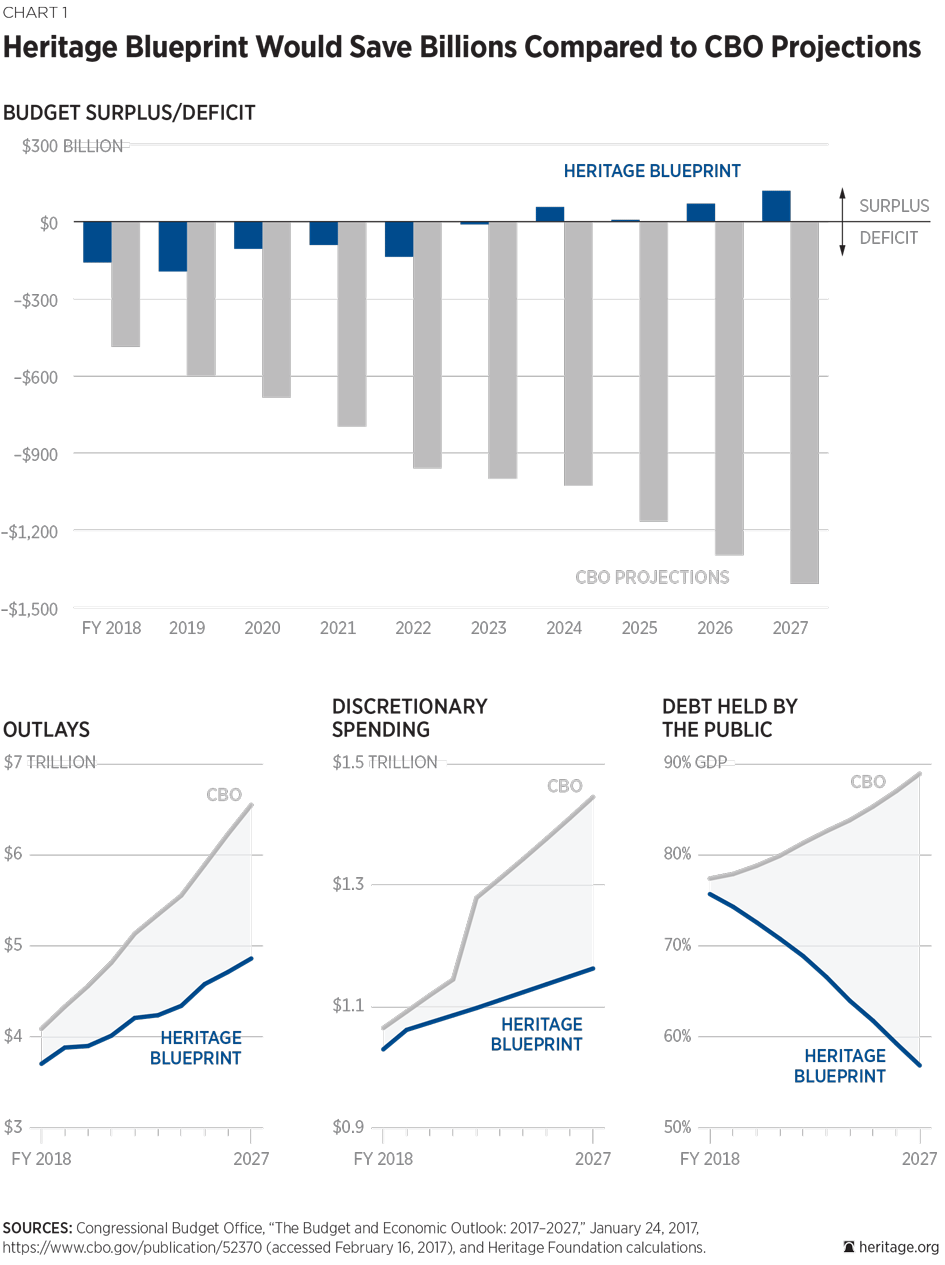

Americans have reached a critical point. The federal government has grown to an unprecedented size, has expanded its scope to virtually every part of the economy, and is on a dangerous fiscal trajectory. Taxpayers pay enormous amounts of money to the government, and the government borrows huge sums beyond the amount it takes from taxpayers. The government uses taxes and borrows money to pay for excessive spending, including many programs that benefit the well-connected or lock people into low incomes by penalizing work. As of March 2017, the national debt is approaching $20 trillion. According to the Congressional Budget Office, if the government remains on its currently planned trajectory, it will spend at least another $10 trillion more than it will collect over the 2017 to 2027 period, piling on even more debt.

Annual debt-service payments are expected to double within five years, and more than triple over the next 10 years, increasing from $241 billion in 2016 to $768 billion in 2027. That $768 billion in interest that the government must pay in 2027 represents 52 percent of the entire amount of the discretionary spending projected for the government in that year. The country cannot and should not sustain the current course of excessive spending and borrowing.

While Congress cannot solve everything at once, it can and must take the opportunities available in the annual budget and appropriations processes to make a down payment on putting the government’s finances in order. Congress can do this by immediately reducing discretionary spending and taking meaningful steps to reduce mandatory spending by reforming mandatory spending programs.

Congress should use four criteria to assess every federal program in developing the FY 2018 budget. Congress should determine whether:

- The program’s elimination would increase opportunity or reduce favoritism;

- The program would better serve the American people if it were administered and financed by the private sector;

- The program would be better administered by state or local governments; or

- The program is wasteful or duplicative.

Congress should use the annual appropriations process to advance important policy objectives. The Constitution unequivocally grants Congress the exclusive power to appropriate funds for the operations of government. James Madison wrote in Federalist No. 58 that providing budgetary powers to Congress was a critical element in maintaining individual rights: “The power over the purse may, in fact, be regarded as the most complete and effectual weapon with which any constitution can arm the immediate representatives of the people for obtaining a redress of every grievance, and for carrying into effect every just and salutary measure.”

Congress should prepare honest budgets and pass legislation that brings current law into compliance with congressional budget plans. The American people have lost trust in Washington, in part because their representatives in Congress say one thing and do another. However, for the well-connected, Washington is a finely tuned machine aimed at avoiding principled arguments and keeping the gravy train rolling for special interests.

Congress must end the practice of using budget gimmicks to mask overspending, and stop using parliamentary process to make excuses for not advancing the policies it was elected to pursue. Congress should use the budget process to promote free enterprise, limited government, individual freedom, traditional American values, and a strong national defense. By reducing debt and putting the fiscal house in order, Congress can produce a strong economy, a strong society, and a strong America.

The federal budget for FY 2018 presented here will:

- Slow the growth in spending, while fully funding national security needs;

- Cut taxes by more than $1 trillion over 10 years;

- Balance the budget within seven years;

- Reduce spending by $10.0 trillion and cut the deficit by $9.0 trillion over 10 years;

- Eliminate budget gimmicks and improve the budget process; and

- Eliminate programs that produce favoritism and limit opportunity.

Chapter 1: Policies for a Congressional Budget

Each year, Congress is required to pass a budget resolution that addresses the entirety of the federal budget: all spending and all taxes. While the budget resolution does not carry the force of law, it is a key tool for Congress to lay out its vision for the nation and establish policy goals for the following fiscal year and the years ahead.

The budget resolution also sets the stage for enabling Congress to follow through on its vision with separate legislation, especially budget reconciliation, which allows a bill to bring current law into compliance with the resolution to be fast-tracked in Congress, and makes it filibuster-proof in the Senate.

With nearly $20 trillion in national debt, and an annual deficit projected to grow from a half trillion dollars to more than a trillion dollars before the end of the decade, the budget resolution presents a critical opportunity for Congress to address the key drivers of the government’s financial problems: spending and debt. Sustainable budgeting is a bipartisan problem.

Congress should put the budget on a path toward balance in order to reduce debt and enable economic growth to raise living standards for all Americans, while reducing the tax burden and strengthening national defense.

Congress should repeal Obamacare and reform the major entitlement programs: Medicare, Medicaid, Social Security, and welfare. Congress should ensure that America’s veterans receive quality, timely, and affordable health care that is focused on the unique needs of service-related conditions.

To strengthen civil society, Congress should protect life and conscience and defend religious liberty. In reviving true federalism, Congress should leave matters of infrastructure, natural resource management, education, and welfare principally to states and localities and the private sector.

Congress should also review Federal Reserve policy and restrain the central bank’s discretion. Reducing harmful regulations will enable entrepreneurs and businesses to expand the economy and enhance opportunity for all Americans to achieve their version of the American dream. This chapter outlines the major policy objectives that should guide the congressional budget.

Balanced Budget. Congress should reduce spending, cut taxes, protect the nation, and reduce the reach of special interests and the government into the lives of the American people. The proposals outlined here would balance the primary deficit (the deficit not including interest payments) within the first year of enactment. However, the annual deficit including interest payments will not reach balance until 2024 (or perhaps earlier with a dynamic calculation that would take account of economic growth sparked by reductions in federal spending and taxation). Under this proposal, debt-service payments would grow from $293 billion in 2018 to $513 billion in 2027 to pay for the debt accumulated before the plan is enacted. This proposal illustrates why it is so critical to reduce spending before even more debt is added to the federal balance sheet.

Strong National Defense. Congress should prioritize national security spending to fund critical defense needs and begin rebuilding of military capabilities after years of defense cuts. Under current law, the fiscal year (FY) 2018 defense budget level is below the FY 2017 level in nominal terms, and is well below what is needed to defend the country. The Heritage Foundation’s 2017 Index of U.S. Military Strength rated the U.S. military as “marginal” due to cuts to capacity, which hurt both capability and readiness.

To begin rebuilding the military will require a significant funding increase for defense. Instead of continuing to shortchange our national defense, Congress should increase defense spending to preserve military capacity, increase readiness, and make investments in modernization. Congress should work with President Donald Trump to expand and strengthen the military and improve national security. While a strong defense budget alone is not enough to keep the U.S. safe, a weak defense budget leads to a weak military and invites further provocations from America’s enemies.

Restoring Economic Freedom. Economic freedom in the United States has declined in nine of the past 10 years. According to The Heritage Foundation’s 2017 Index of Economic Freedom, the U.S. is ranked the 17th-freest economy in the world, registering its lowest economic freedom score since the Index was first published in 1994. Large budget deficits and a high level of public debt have contributed to the continuing decline of economic freedom in the United States. America’s competitiveness in the world, as shown by the anemic economic recovery since the Great Recession, has been undermined by the increased size and scope of the government, including soaring regulatory and tax burdens. The perception of government cronyism, elite privilege, and corruption has reduced individual and business confidence in the U.S. economy. While the U.S. is currently deeply mired in the ranks of the “mostly free”—the second-tier economic freedom status into which it dropped in 2010—Congress can make substantial progress in restoring economic freedom by adopting the proposals in this budget.

Pro-Growth Tax Reform. Federal taxes should exist to raise only those revenues necessary to fund the constitutionally prescribed duties of the federal government. Revenues should be collected in the least economically damaging manner. The U.S. system fails Americans on both fronts: Taxes are too high, and the tax system is much more economically destructive than it should be.

The U.S. tax code’s complexity and structure harms economic growth, productivity, job creation, and real wage increases. Fundamental tax reform would alleviate the harm caused by the tax system and thereby significantly expand the size of the economy. Stronger economic growth would substantially improve the incomes of Americans, and enhance their economic opportunities.

Fundamental tax reform should lower individual and business tax rates; establish a consumption tax base, rather than the hybrid income-consumption tax base that the current system uses; eliminate the bias against saving and investment; eliminate tax preferences; simplify the tax system; and make the U.S. tax system more transparent so that taxpayers understand how much they are paying every year to fund the federal government.

True Federalism. The U.S. should restore respect for the traditional role of states in this country’s federal system, a federalism that has eroded steadily with the excessive growth of the federal government. Contrary to popular belief, federalism should not be in the service of the states, but in in the service of the American people. States do not possess rights—people do.

Properly understood, federalism aims not only to limit power, but to create competition among the states, thereby creating incentives for them to enact policies that retain and attract citizens. Within the confines of the Constitution, states should therefore be free to enact policies that best serve the needs of their citizens.

To revive true federalism, Congress should focus on its core constitutional responsibilities and not treat the states as administrative sub-units tasked with helping to implement federal policies using federal funds. Because Congress is now involved in so many areas, Congress must propose issue-specific reforms that will restore constitutional governance in each of these areas. Congress should also stop trying to induce states to adopt its preferred policies by making state acceptance of these policies a condition of states’ receiving federal funds. Rather, Congress should leave to the states those programs that do not carry out a constitutional function of the federal government, or that otherwise ought to be handled by states.

No Hidden Taxes Through Regulation. Federal spending and revenues constitute only one part of the total burden imposed on Americans by Washington. Rules imposed by federal regulators also impose crushing costs on the U.S. economy and society. During the Obama Administration alone, these costs increased by over $100 billion annually.

Congress, along with the new President, must reverse this out-of-control regulatory growth. It should start by repealing the harmful and unnecessary rules that have been imposed on Americans. These range from restrictions on Internet providers to Obamacare health insurance mandates to costly limits on energy production and greenhouse gases. Next, Congress should require that every major new rule be approved by the House and Senate before taking effect. Moreover, existing rules should be subject to automatic expiration (often called “sunsetting”) if not specifically renewed after a certain time.

Support for Entrepreneurship Through Reformed Securities Laws. A morass of securities regulations impede capital formation, disproportionately harm small and start-up businesses, and reduce innovation and economic growth. Securities laws should focus primarily on the core mission of deterring and punishing fraud, and require reasonable, limited, scaled disclosure by widely held firms of material information required by investors to make informed investment decisions, such that larger and even more widely held firms are subject to greater disclosure requirements.

The modern securities market is generally interstate in character, and therefore most primary offerings, secondary markets, and broker-dealers should be subject only to the federal regulatory regime, while state securities regulation should be limited to intrastate offerings and anti-fraud enforcement rather than offering registration and qualification. The law should allow the development of robust secondary markets in the securities of smaller companies by improving existing secondary markets for small public companies, establishing a regulatory environment that enables venture exchanges, and reasonably regulating the secondary sales of private securities. Regulators should not engage in “merit review” or mandate particular portfolio choices; regulators should not substitute their investment or business judgment for that of investors.

Rules-Based Monetary System. Many take for granted that the Federal Reserve has contributed positively to economic stabilization, but the U.S. has experienced severe economic turmoil in at least four different decades since the Fed was founded. Recessions have not become less frequent or shorter in duration, output has not become less volatile, and some of the worst U.S. economic crises have occurred on the Fed’s watch. Furthermore, the Fed’s action during the 2008 financial crisis is only the latest example of its long history of propping up failing firms—throughout its history, the Fed has operated within a purely discretionary policy framework.

Congress should reduce the Fed’s discretion in monetary policy and direct the central bank to implement rules-based policies that move the U.S. toward a truly competitive monetary system. Congress should also review the effectiveness of the Federal Reserve with a formal commission. Finally, Congress should require the Fed to announce a plan detailing how it will normalize its balance sheet and dispose of the government-sponsored enterprise (GSE) securities it bought.

Promotion of the Freedom to Trade. The freedom to exchange goods and services openly with others is the foundation of America’s modern economic system, which provides historically unprecedented opportunities for individuals to achieve greater economic freedom, independence, and prosperity. According to data in the annual Index of Economic Freedom, countries with low trade barriers are more prosperous than those that restrict trade. Open trade fuels vibrant competition, innovation, and economies of scale, allowing individuals, families, and businesses to take advantage of lower prices and increased choice.

The United States has trade agreements with 20 countries around the world that reduce most taxes on imports from these countries to zero. These agreements cover only about 36 percent of U.S. annual imports, and Congress should further eliminate trade barriers and protectionist policies to increase Americans’ economic freedom. Nearly half of U.S. imports are intermediate goods (goods that are components used in making other goods), and U.S. manufacturers rely on these imported inputs to create American jobs and to compete in the global marketplace. The government should boost manufacturing by eliminating all taxes on imports of intermediate goods. Because the government should not be in the business of picking winners and losers, policies like the sugar program, which causes the price of sugar in the U.S. to be much higher than the global average, and the maritime Jones Act, which mandates that any goods shipped by water from one point in the U.S. to another U.S. location must be transported on U.S.-built vessels, should be eliminated.

Improving Efficacy and Accountability in Infrastructure Funding. Federal funding makes up about one-quarter of public spending on transportation infrastructure. Expansions of the federal role over the last half-century have crowded out other sources of funding and led to diminution in efficiency, accountability, and fiscal responsibility of infrastructure spending. These expansive top-down decisions have led to a misallocation of resources, and poor incentives in public spending.

In surface transportation, the Highway Trust Fund has been continuously diverted to non-highway projects and has required extensive general-fund bailouts due to overspending. Discretionary grant programs administered at the federal level further create perverse incentives for states and localities to build new, unnecessary transit projects while badly needed maintenance of vital infrastructure goes unfunded. In aviation, federal airport improvement grants and prohibitive regulations siphon resources from the most important airports and distribute it to those of far less significance. The Federal Aviation Administration’s Air Traffic Control continues to be run like a bureaucracy instead of a high tech business.

In order to spend more wisely on vital infrastructure that will improve both geographic and economic mobility, the federal role in funding should be restricted to a small group of issues strictly of national importance. This will leave the vast majority of funding decisions to states, localities, and the private sector, which can set priorities more effectively, identify and meet specific needs, and are more accountable to the public. Removing the federal middle man from infrastructure decisions will empower states, localities, and the private sector to build the infrastructure that best suits people’s needs while restoring accountability to a system currently mired in federal mismanagement.

Repeal of Obamacare. Obamacare is unpopular, unaffordable, and unworkable. Congress should repeal Obamacare in its entirety. This would eliminate the nearly $2 trillion in new spending created by the law’s exchange subsidies and Medicaid expansion, as well as more than a trillion dollars in new taxes. In addition, full repeal would alleviate the burdens caused by Obamacare’s costly and onerous federal insurance regulations that have caused massive disruption in the insurance market and dramatically increased costs. Repeal is essential to controlling government health care spending and to clear the way for an alternative reform that is patient-centered and market-based.

Patient-Centered, Market-Based Health Care Reform. Congress should put in place a framework for a health care reform alternative. This proposal should promote a free market for health care by removing the federal regulatory and policy obstacles that discourage choice and competition, and address the major drivers in health care spending.

A replacement package should encourage personal ownership of health insurance by reforming the tax treatment of health insurance. Tax relief should be extended for individuals to purchase the coverage of their choice, and the value of the tax exclusion for employer-based health care should be capped.

Medicaid as a True Safety Net. A replacement package should also restore Medicaid to a true safety net. Federal Medicaid assistance for able-bodied individuals should be converted to a direct, defined contribution to facilitate participation in the private marketplace. Federal Medicaid assistance for the low-income elderly should be folded into the Medicare program to streamline seniors’ health benefits. For the disabled population, payments to states should be limited to ensure fiscal control but also allow states flexibility to tailor their programs to the specific needs of their population.

Modernize Medicare. A replacement package should also modernize the Medicare program so that it can meet the growing demographic, fiscal, and structural challenges. Medicare should transition to a defined-contribution, premium support model. To prepare the way, smaller Medicare changes—such as raising the retirement age, reducing subsidies for wealthy seniors, and consolidating benefits—would help make the transition to premium support smoother.

Welfare Reform. The current U.S. welfare system has failed the poor. It fails to promote self-sufficiency, and its cost is unsustainable. Total federal and state government spending on dozens of different federal means-tested welfare programs now reaches over $1 trillion annually. However, most policymakers, along with the American public, are not aware of the full cost of welfare. Congress should include in its annual budget an estimate of total current welfare spending, as well as 10-year projections.

There is dignity and value in work, in supporting one’s self and one’s dependents. Welfare reform should encourage work, a proven formula for reducing dependence and controlling costs. The food stamp program, one of the largest of the government welfare programs, would be a good place to start: Able-bodied adults receiving food stamps should be required to work, prepare for work, or look for work as a condition of receiving assistance. The work requirements of the Temporary Assistance for Needy Families program, put into place by the 1996 welfare reform, are much too weak today and must be strengthened.

The vast majority of welfare spending is federal, even when administration of the program occurs at the state level. Because states are not fiscally responsible for welfare programs, they have little incentive to curb dependence or to rein in costs. States should gradually assume greater revenue responsibility for welfare programs; that is, they should pay for and administer the programs with state resources. A first step would be to gradually return fiscal responsibility for all subsidized housing programs to the states.

Additionally, leaders should look for ways to strengthen marriage. The absence of fathers in the home is one of the greatest drivers of child poverty, yet the welfare system penalizes marriage. Policymakers should eliminate marriage penalties in the current welfare system. A place to begin would be with the earned income tax credit (EITC). By reducing widespread fraud in the EITC, policymakers could not only restore integrity to the EITC program and reap large savings, but a portion of that savings could be put toward eliminating marriage penalties in the rest of the welfare system.

Limit Federal Intervention and Restore State and Local Control of Education. Since President Lyndon B. Johnson signed the Elementary and Secondary Education Act (ESEA) into law in 1965 as the keystone education component of his War on Poverty, the federal government—which represents 10 percent of all K–12 education spending—has appropriated some $2 trillion in an effort to improve the educational outcomes of American students. Despite a more than doubling of inflation-adjusted federal per-pupil expenditures since that time, only slightly more than one-third of children in grades four and eight are proficient in reading—a figure effectively unchanged since the early 1970s. Moreover, achievement gaps among students remain, and graduation rates for disadvantaged students are stagnant.

These lackluster outcomes—and in some cases declines—in academic performance come despite continued increases in education spending. These underwhelming outcomes add to the evidence that ever-increasing government spending is not the key to improving education. In order to shift education functions from the federal government to state and local leaders, Congress should limit federal intervention in education, beginning by eliminating ineffective and duplicative programs and offering relief to states and schools through reforms in the Academic Partnerships Lead Us to Success (A-PLUS) Act.

Higher Education Accreditation Reform and Restraint in Federal Higher Education Subsidies. When tax credits and deductions are included, total aid for higher education, including non-federal sources, exceed $250 billion annually. Federal aid alone accounts for more than $158 billion annually. Federal higher education subsidies have increased substantially over the past decade. The number of students who borrow money through federal student loans increased by 64 percent—from 5.9 million students during the 2002–2003 academic year, to some 9.7 million today. At the same time, Pell Grant funding has more than doubled in real terms; the number of recipients has nearly doubled over the same time period.

As federal subsidies have increased, so, too, have college costs. Since 1980, tuition and fees at public and private universities have grown at least twice as fast as the rate of inflation. Some 60 percent of bachelor’s degree holders leave school with more than $26,000 in student loan debt, with cumulative student loan debt now exceeding $1.2 trillion.

To increase access to and affordability of higher education, policymakers should limit federal subsidies and spending, which have contributed to increases in costs. In order to truly drive down college costs and improve access for students, policymakers should undertake major reforms to accreditation, including decoupling federal financing from the ossified accreditation system.

Access to Natural Resource Production, Increased Trade Opportunities, and Empowered States. With the abundance of resources beneath U.S. soil, this land is literally a land of opportunity. America has an abundance of natural resources, including plentiful reserves of coal, natural gas, uranium, and oil. Federal government control of vast tracts of America’s land and federal regulations have stymied proper management of lands and development of natural resources. Furthermore, the government has placed restrictions on trading energy that blocks opportunities to expand to new markets.

Congress should open access to natural resource development in the U.S., allow states to control the environmental review and permitting processes within their borders, and open opportunities to freely import and export energy resources and technologies.

Elimination of All Energy Subsidies. Over the years, Congress has implemented numerous policies to subsidize the production or consumption of one good over another, including through direct cash grants, special tax treatment, taxpayer-backed loans and loan guarantees, socialized risk through insurance programs, mandates to produce biofuels, tariffs, and energy sales at below-market costs. Whatever shape such favoritism takes, the results are always the same: The government delivers benefits to a small, select group and spreads the costs across the economy to families and consumers.

Subsidies significantly obstruct the long-term success and viability of the very technologies and energy sources that they intend to promote. Instead of relying on a process that rewards competition, taxpayer subsidies prevent a company from truly understanding the price point at which the technology will be economically viable. Congress should eliminate preferential treatment for every energy source and technology and let a free market in energy work to the benefit of Americans.

Reform of Social Security, Including Disability Insurance. Social Security’s Old Age Survivors and Disability Insurance (OASDI) programs provide a false sense of security by promising more in benefits than they can pay. Combined, these programs cost $1 trillion in 2018—about one-quarter of the federal budget—to provide benefits to 60 million beneficiaries. OASDI’s combined unfunded obligation over the 75-year horizon tops $13 trillion.

Although Congress avoided the DI program’s 2016 insolvency by raiding $150 billion from the OASI Trust Fund, the DI program remains plagued by widespread fraud and abuse, excessive structural flaws and inefficiencies, and work disincentives. To address these problems, policymakers should introduce an optional private DI component; improve work incentives; adopt a needs-based period of disability; eliminate the non-medical vocational grids that allow individuals to receive benefits based on their age, education, or skill; and instruct the Social Security Administration to improve the program’s efficiency and integrity.

Within Social Security’s retirement program, lawmakers should gradually and predictably increase the program’s early and full retirement ages to account for increases in life expectancy, and then index both to longevity. Across both the OASI and DI programs, policymakers should transition to a flat, anti-poverty benefit focused on individuals who need it most, and immediately replace the current cost-of-living adjustment with the more accurate chained consumer price index. More individuals should be empowered to save for retirement through private means.

Veteran-Centered Reform of the VA Health System. The U.S. Department of Veterans Affairs (VA) health care delivery system is in need of comprehensive reform to ensure that America’s veterans receive quality, timely, and affordable health care that is consistent with the changing health care demands of the veteran population and not the institutional concerns of the VA.

First of all, the VA should immediately develop a clear and consistent strategy for ending its current access crisis by allowing VA patients who face excessive wait times or travel-related delays to receive medical care in the private sector. The decisions about when and where to receive care should be based on veteran-specific health care circumstances rather than time or distance restrictions or the arbitrary judgment of VA administrators.

In addition, the VA should resolve the current personnel and management failures by ensuring an adequate supply of highly competent clinicians and by demanding accountability from all employees, regardless of their level within the organization.

More fundamental, fiscally responsible longer-term reforms should include refocusing the use of limited resources on service-related health care needs, especially those services for which the VA has a unique expertise, such as poly-trauma, posttraumatic stress disorder (PTSD), and rehabilitation. However, if a veteran can receive better care at a non-VA facility, especially for non-service-related issues, the VA should facilitate access to those services. These reforms should be fiscally responsible, providing quality care in a cost-effective way. In addition, reforms should be based on a longer-term policy and budget window and avoid the pattern of enacting short-term fixes.

Protection of Life and Conscience. Since the Supreme Court’s 1973 decisions in Roe v. Wade and Doe v. Bolton, inventing a right to abortion on demand, the pro-life movement has worked tirelessly to re-orient the hearts and minds of an entire generation toward the dignity and worth of every existing individual—born and unborn. Despite major pro-life victories over the past four decades, the challenges to life and conscience that inevitably stem from sanctioned abortion on demand persist.

Policymakers should return to a deeper respect for foundational American principles by protecting the freedom of conscience of individuals, medical providers, and taxpayers, and ensuring the basic rights of liberty and life for everyone, including those still in the womb.

There is long-standing, broad consensus that federal taxpayer funds should not be used for elective abortions or for health insurance that includes coverage for elective abortions. Policymakers should close the patchwork of federal prohibitions on abortion funding by making policies, such as the annually re-enacted Hyde amendment—which prohibits the use of certain federal funds for abortion coverage—permanent across federal law, and enact permanent prohibitions on use of taxpayer funding to encourage or pay for abortions overseas, through foreign aid or otherwise.

American taxpayers simply should not be forced to subsidize the abortion industry. Policymakers should end taxpayer funding for the Planned Parenthood Federation of America affiliates and all other abortion providers, and redirect funding to centers that provide health care for women without entanglement in on-demand abortion. Policymakers should also enact permanent conscience protections for individuals, families, employers, and insurers to keep them from being forced to offer, provide, or pay for coverage that violates their conscience.

Defense of Religious Liberty. The freedom to earn a living, care for the poor, heal the sick, and serve the community in ways that are consistent with one’s beliefs is essential for maintaining a just and free society—and this freedom has suffered erosion in recent years. The right of Americans and institutions to exercise their religious beliefs is not confined to the private sphere, and is protected from government burden and discrimination in public life.

America must return to a more reasonable and historically accurate understanding of religious liberty, upholding religious and moral conscience as an invaluable support for healthy republican government and human flourishing. In 2015, the Supreme Court imposed a redefinition of marriage on all 50 states in the decision of Obergefell v. Hodges. Policymakers should promote policies that protect from discrimination those who believe that marriage is the union of one man and one woman. Congress should enact laws to prevent the government from discriminating in regard to contracts, grants, licensing, accreditation, or the award or maintenance of tax-exempt status, against any person or group on the basis of speaking or acting on the belief that marriage is the union of one man and one woman.

A Vision for America. The congressional budget resolution provides Congress with a critical opportunity to review federal policy in all areas and to put forth a strong vision for an America that offers opportunity for all with favoritism to none. Congress should seize this opportunity to begin to drive down federal spending to a balanced budget, while reducing taxes, freeing the economy, and maintaining a strong national defense

Chapter 2: Budget Proposals

The congressional budget process calls for an authorization to be made before appropriations are provided for federal activities. The authorizations process allows for regular scrutiny and review of federal activities. When followed, this process establishes, continues, discontinues, or modifies federal agencies or programs. Yet, lawmakers rarely follow the authorization process. This evades the careful congressional scrutiny of programs and agencies that congressional rules require and federal taxpayers deserve. Congress should authorize only those programs that represent federal constitutional priorities, eliminating funding for activities that the federal government should not undertake. No funds should be provided for activities that have not been authorized.

The appropriations process calls on Congress to pass appropriations bills (currently 12 in number) each year, before the start of the government’s fiscal year on October 1. Appropriations are supposed to fund the government’s operations for that fiscal year (FY). The appropriations bills cover a number of policy areas such as defense, health, energy, and agriculture, among others. Spending on programs funded annually through appropriations bills (often referred to as “discretionary spending” as distinguished from so-called “mandatory spending” for which Congress has passed laws making permanent appropriations instead of periodic appropriations) currently makes up about one-third of the total federal budget. Two-thirds of spending goes for “mandatory spending” and payment of interest on the national debt.

Congress should review programs during the authorization and appropriation process to ensure that they fall within the powers delegated to the United States by the Constitution, as ours is a federal government of limited powers. Congress should also use the appropriations bills, like other bills, to advance important policy objectives, within the limits of its authority. Congress can do so, for example, by adding provisions, known as “riders,” that direct or prohibit the use of funds for specified purposes.

Congress should determine whether:

- Eliminating the program would increase opportunity or reduce favoritism;

- The program would better serve the American people if it were administered and financed by the private sector;

- The program would be better administered by state or local governments; or

- The program is wasteful or duplicative.

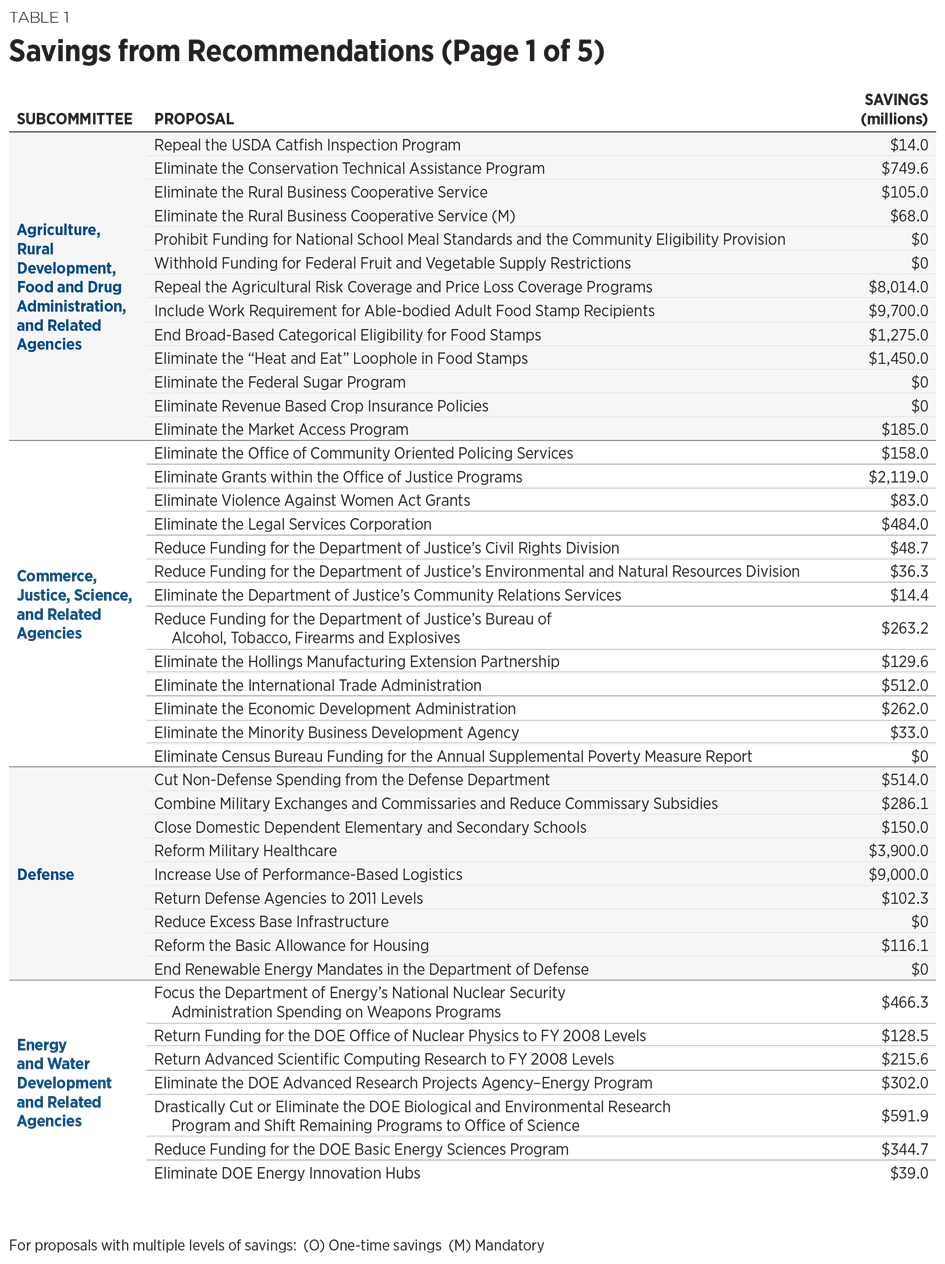

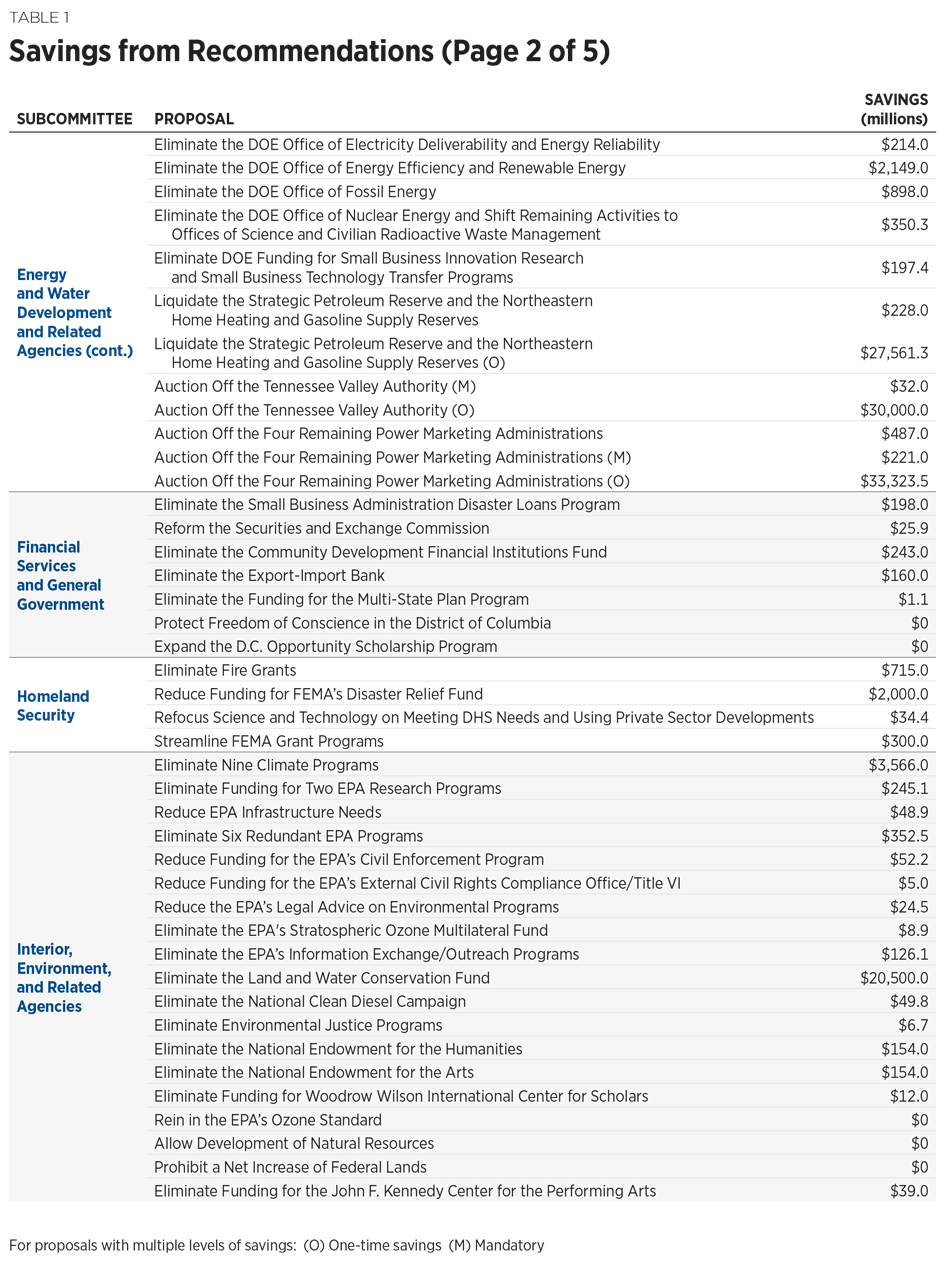

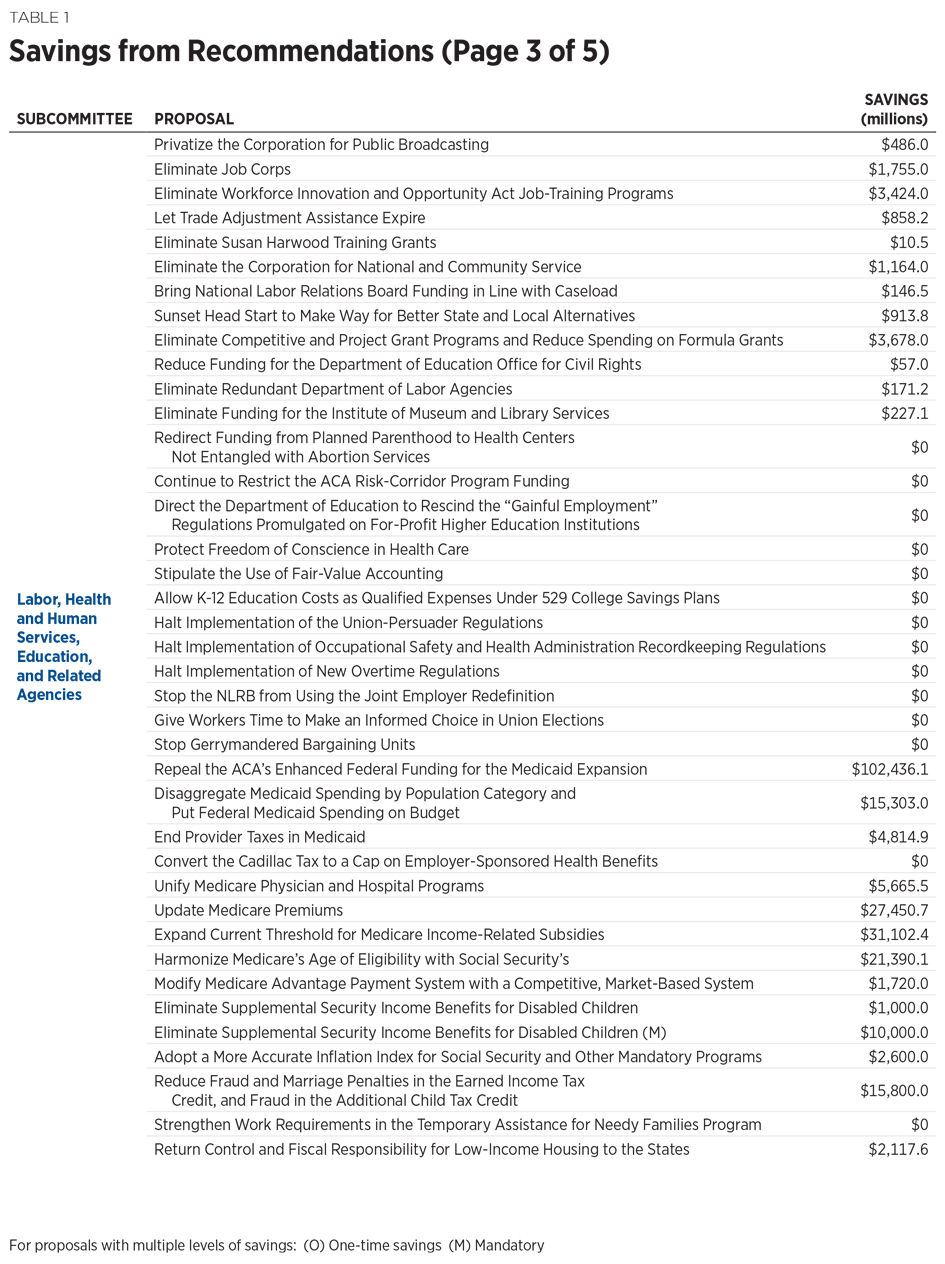

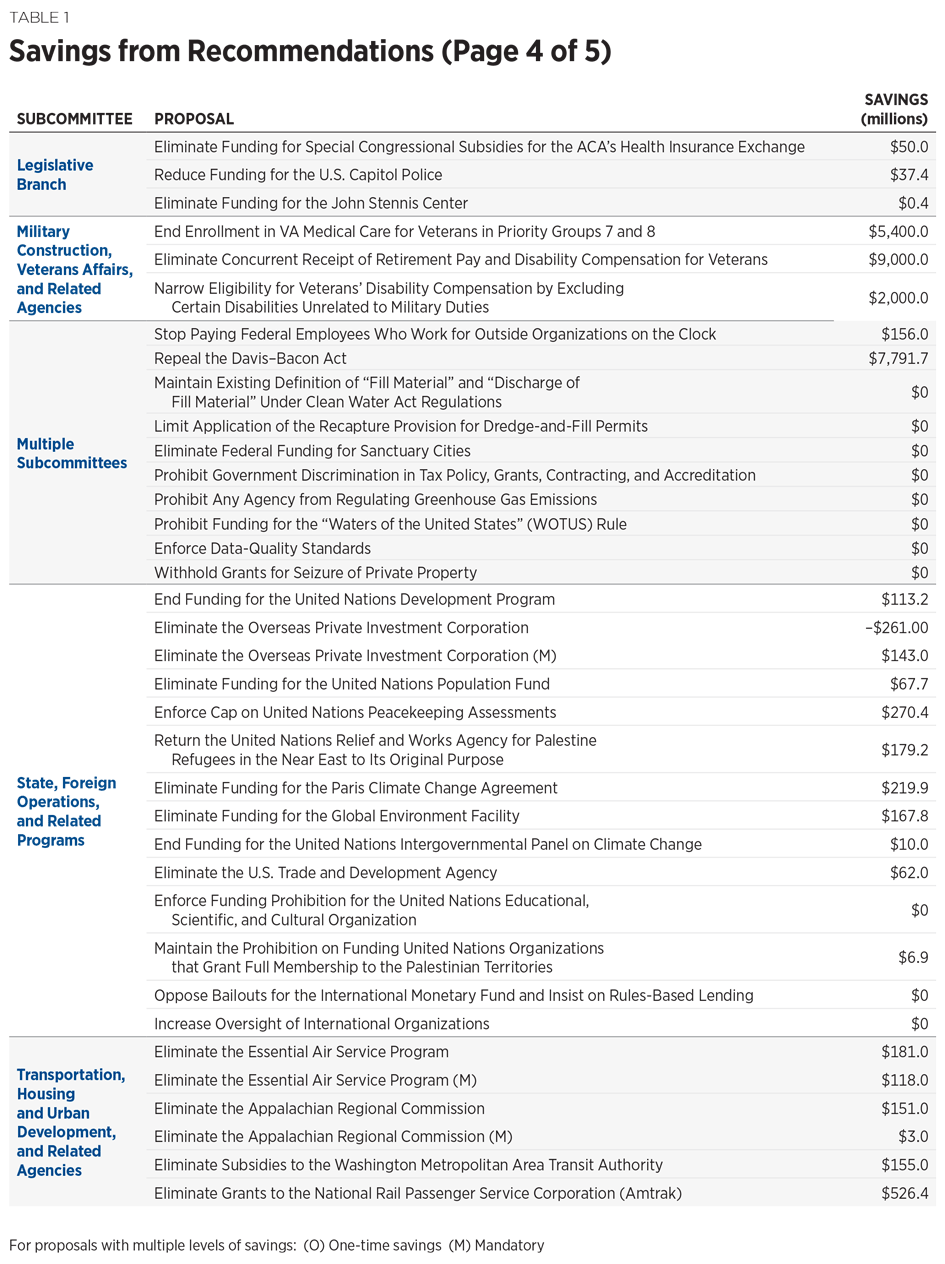

This chapter provides proposals to reduce and reform mandatory and discretionary programs and agencies for the FY 2018 budget process. Some of the proposals produce savings in defense programs; those savings should be shifted to higher priority defense programs, to help achieve a stronger national defense. If enacted, these proposals would significantly reduce the size and scope of the federal government, reining in federal bureaucrats, to unleash the economic potential of the United States, enhance individual freedom, and strengthen civil society.

SECTION 1: Agriculture, Rural Development, Food and Drug Administration, and Related Agencies

REPEAL THE USDA CATFISH INSPECTION PROGRAM

Recommendation

Repeal the U.S. Department of Agriculture’s (USDA’s) catfish inspection program. This proposal saves $14 million in FY 2018.

Rationale

While the Food and Drug Administration (FDA) regulates domestic and imported seafood, the 2008 farm bill created a special exception requiring the USDA to regulate catfish that is sold for human consumption. This program, which has not yet been implemented, would impose costly duplication because facilities that process seafood, including catfish, would be required to comply with both FDA and USDA regulations.

The evidence does not support the health justifications for the more intrusive inspection program, to which there has been wide bipartisan opposition. The Government Accountability Office (GAO) has criticized the program, publishing a 2012 report with the not-so-subtle title “Seafood Safety: Responsibility for Inspecting Catfish Should Not Be Assigned to USDA.”[REF] Another GAO report succinctly summarized most of the problems, noting that the program “would result in duplication of federal programs and cost taxpayers millions of dollars annually without enhancing the safety of catfish intended for human consumption.”[REF]

The USDA catfish inspection program would also have serious trade implications. Foreign countries that want to export catfish to the U.S. would need to establish a new regulatory system equivalent to the USDA program. If these countries do not meet the USDA’s requirements, foreign exporters from countries that currently supply the United States with catfish will be blocked from doing so. This approval process could take years. Catfish-exporting countries would likely retaliate with—and win—trade disputes, since the program would be an unjustified trade barrier. The retaliation would likely be against industries other than the catfish industry, such as milk producers or meat packers. American consumers would also suffer, as this program would reduce competition.

Additional Reading

- Daren Bakst, “House Leadership Should Allow a Vote Against Cronyism,” The Daily Signal, September 19, 2016.

- Daren Bakst, “Senate Votes to End a Textbook Crony Program,” The Daily Signal, May 26, 2016.

- Daren Bakst, “Addressing Waste, Abuse, and Extremism in USDA Programs,” Heritage Foundation Backgrounder No. 2916, May 30, 2014.

- Daren Bakst, “Farm Bill: Taxpayers and Consumers Are Getting Catfished,” The Daily Signal, November 19, 2013.

- U.S. Government Accountability Office, “High Risk Series: An Update,” GAO–13–283, February 2013, pp. 198–199.

- U.S. Government Accountability Office, “Seafood Safety: Responsibility for Inspecting Catfish Should Not Be Assigned to USDA,” GAO–12–411, May 2012.

Calculations

As reported in U.S. Government Accountability Office, “Seafood Safety: Responsibility for Inspecting Catfish Should Not Be Assigned to USDA,” Report to Congressional Requesters, GAO–12–411, May 2012, pp. 19 and 20, the proposed catfish program would cost the federal government and industry an estimated $14 million annually, with the federal government bearing 98 percent of the cost. This GAO report notes that the reported estimate of $14 million annually may understate the true costs of the program.

ELIMINATE THE CONSERVATION TECHNICAL ASSISTANCE PROGRAM

Recommendation

Eliminate the Conservation Technical Assistance Program. This proposal saves $750 million in FY 2018.

Rationale

The Natural Resources Conservation Service runs a costly program to offer technical assistance to landowners on natural resource management. This assistance includes help in maintaining private lands, complying with laws, enhancing recreational activities, and improving the aesthetic character of private land. Private landowners, not government, are the best stewards of a given property. If necessary, they can seek private solutions to conservation challenges. Federal taxpayers should not be forced to subsidize advice that landowners should be paying for on their own.

Additional Reading

Calculations

Savings is expressed as budget authority and was calculated using the FY 2016 estimated spending level of $752 million as found in USDA, “FY 2017: Budget Summary and Annual Performance Plan, U.S. Department of Agriculture,” p. 63. This estimate assumes that the FY 2016 spending level holds constant in FY 2017 and decreases at the same rate as discretionary spending in FY 2018 (–0.32 percent), according to the CBO’s most recent August 2016 baseline spending projections.

ELIMINATE THE RURAL BUSINESS COOPERATIVE SERVICE

Recommendation

Eliminate programs in the Rural Business Cooperative Service (RBCS). This proposal saves $105 million in FY 2018.

Rationale

The RBCS is an agency of the U.S. Department of Agriculture that has a wide range of financial assistance programs for rural businesses. It also has a significant focus on renewable energy and global warming, including subsidizing biofuels. Rural businesses are fully capable of running themselves, investing, and seeking assistance through private means. The fact that these businesses are in rural areas does not change the fact that they can and should succeed on their own merits like any other business. Private capital will find its way to worthy investments. The government should not be in the business of picking winners and losers when it comes to private investments or energy sources. Instead of handing taxpayer dollars to businesses, the federal government should identify and remove the obstacles that it has created for businesses in rural communities.

Additional Reading

Calculations

Savings are expressed on budget authority based on the CBO’s most recent August 2016 baseline spending projections. Savings include $105 million in discretionary spending and $68 million in mandatory spending.

PROHIBIT FUNDING FOR NATIONAL SCHOOL MEAL STANDARDS AND THE COMMUNITY ELIGIBILITY PROVISION

Recommendation

Prohibit funding for national school meal standards and the community eligibility provision. This proposal has no savings for FY 2018.

Rationale

The U.S. Department of Agriculture’s school-meal standards for the Healthy, Hunger-Free Kids Act of 2010 have been a failure. These standards are a burden on schools and have resulted in many negative outcomes. A September 2015 GAO report on the school lunch program shows that since the implementation of the new standards, participation in the school lunch program has declined, and food waste remains a significant problem. As reported, some schools have dropped out of the school lunch program at least partially due to the new standards.[REF] The new standards have also imposed greater costs on schools, such that some have even have had to draw from their education funds to cover the new costs.[REF] No funding should be directed toward implementation or enforcement of these standards. Any new standards should give states and local educational authorities much greater flexibility and respect the role of parents in helping their children make dietary decisions.

The community eligibility provision is a new policy that was implemented by the Healthy, Hunger-Free Kids Act. It expands free school meals to students regardless of family income. Under this provision, if 40 percent of students in a school, group of schools, or school district are identified as eligible for free meals because they receive benefits from another means-tested welfare program like food stamps, then all students can receive free meals. The community eligibility provision is essentially a backdoor approach to universal school meals. Schools should not be providing welfare to middle-class and wealthy students. Ending the community eligibility provision would ensure that free meals are going only to students from low-income families. No further funding should be directed toward implementing this provision.

Additional Reading

- Daren Bakst, “Addressing Waste, Abuse, and Extremism in USDA Programs,” Heritage Foundation Backgrounder No. 2916, May 30, 2014.

- Daren Bakst, “Michelle Obama Is Ignoring the Problems Her New School Lunch Standards Have Caused,” The Daily Signal, May 30, 2014.

- Rachel Sheffield and Daren Bakst, “Child Nutrition Reauthorization: Time for Serious Reform, Not Tinkering,” Heritage Foundation Issue Brief No. 4570, May 26, 2016.

- Daren Bakst and Rachel Sheffield, “Congress Shouldn’t Push Obama’s Flawed Child Nutrition Policy on Children,” The Daily Signal, January 25, 2016.

- Daren Bakst and Rachel Sheffield, “Getting the Facts Straight on School Meals and Child Nutrition Reauthorization,” Heritage Foundation Issue Brief No. 4622, November 3, 2016.

- Daren Bakst and Rachel Sheffield, “School Lunch Program: No Wealthy Child Left Behind,” The Daily Signal, May 15, 2016.

Calculations

Ending funding and enforcement for the new standards would generate savings for state and local governments. The effects of these proposals on federal spending are uncertain so Heritage does not include estimated savings for FY 2018.

WITHHOLD FUNDING FOR FEDERAL FRUIT AND VEGETABLE SUPPLY RESTRICTIONS

Recommendation

Withhold funding for federal fruit-supply and vegetable-supply restrictions. This proposal has no savings in FY 2018.

Rationale

In June 2015, the United States Supreme Court decided Horne v. Department of Agriculture,[REF] a case regarding the federal government’s authority to fine raisin growers who did not hand over part of their crop to the government. The court held that forcing growers to turn over their raisins was a taking of private property requiring just compensation. While the “raisin case” received much attention because of the outrageous nature of the government’s actions, it is far from unique. In particular, the USDA uses its power to enforce a number of cartels through industry agreements known as marketing orders. Fruit and vegetable marketing orders[REF] allow the federal government to authorize supply restrictions (volume controls), limiting the amounts that agricultural producers may sell. Marketing orders are bad enough, but, at a minimum, Congress should stop funding these volume controls that limit how much of their own fruits and vegetables farmers may sell, and should get the government out of the market and cartel management business.[REF]

Additional Reading

- Alden Abbott, “Time to Repeal Agricultural Marketing Orders,” Heritage Foundation Backgrounder No. 3054 December 3, 2015.

- Daren Bakst, “The Federal Government Should Stop Limiting the Sale of Certain Fruits and Vegetables,” Heritage Foundation Issue Brief No. 4466, September 29, 2015.

- Elayne Allen and Daren Bakst, “How the Government Is Mandating Food Waste,” The Daily Signal, August 19, 2016.

REPEAL THE AGRICULTURAL RISK COVERAGE AND PRICE LOSS COVERAGE PROGRAMS

Recommendation

Repeal the Agricultural Risk Coverage (ARC) and Price Loss Coverage (PLC) programs. This proposal saves $8.014 billion in FY 2018.

Rationale

The ARC and PLC programs are two major new commodity programs that Congress added in the 2014 farm bill. Essentially, the two programs attempt to insulate farmers from market forces by guaranteeing against lower-than-expected revenue and against price changes.

The ARC program protects farmers from shallow losses (minor dips in expected revenue), providing payments when their actual revenues fall below 86 percent of the expected revenues for their crops. The PLC program provides payments to farmers when commodity prices fall below a fixed reference price established by statute. On a crop-by-crop basis, farmers can participate either in the ARC program or in the PLC program. These programs go far beyond providing a safety net for farmers. Instead, the pretext of a safety net is used to prevent many agricultural producers from competing in the market like other businesses.

The PLC program provides protection against minor dips in revenue, including those that could be attributed to normal business risk. The PLC program has such high reference prices that, even at the time of passage of the 2014 farm bill, payments were likely right from the outset for some commodities. Policymakers need to allow farmers to freely compete in the marketplace, and reap the financial reward of being more efficient and better managed than their competitors. In other words, they should be allowed to operate just like any other business.

Congress should repeal both programs because they go way beyond any concept of a safety net. At most, the taxpayer-funded safety net should only protect farmers from deep yield losses, not insulate farmers from minor dips in revenue and market forces such as prices. This proposal would save $9.618 billion dollars in FY 2018.

Additional Reading

- Daren Bakst et al., “Farms and Free Enterprise: A Blueprint for Agricultural Policy,” The Heritage Foundation, Mandate for Leadership Report, September 21, 2016.

- Daren Bakst, Josh Sewell, and Brian Wright, “Addressing Risk in Agriculture,” Heritage Foundation Special Report No. 189, September 8, 2016.

Calculations

Savings are expressed as budget authority as projected in the CBO’s March 2016 baseline spending projections. Projections for the ARC and PLC can be found in Congressional Budget Office, “CBO’s March Baseline for Farm Programs,” March 24, 2016, https://www.cbo.gov/sites/default/files/recurringdata/51317-2016-03-usda.pdf (accessed February 6, 2017). Estimated savings of $8.014 billion in FY 2018 include $2.521 billion for the PLC (p. 6); $5.42 billion for the ARC-CO (county) (p. 6); and $66 million for the ARC-IC (individual coverage) (p. 9). All $8.014 billion in savings represent mandatory spending.

INCLUDE WORK REQUIREMENT FOR ABLE-BODIED ADULT FOOD STAMP RECIPIENTS

Recommendation

Reform the food stamps program to include a work requirement for able-bodied adults. Able-bodied adults must work, prepare for work, or look for work for a minimum number of hours each month in order to receive benefits. This proposal saves $9.7 billion in FY 2018.

Rationale

The food stamp program is the nation’s second-largest of the government’s roughly 90 means-tested welfare programs. The number of food stamp recipients has risen dramatically from about 17.2 million in 2000 to 44.2 million in 2016. Costs have risen from $19.8 billion in FY 2000 to $83.0 billion in FY 2015.

Food stamp assistance should be directed to those most in need. Able-bodied adults who receive food stamps should be required to work, prepare for work, or look for work in exchange for receiving assistance. Not only do work requirements help ensure that food stamps are directed to those who need them most, a work requirement also promotes the principle of self-sufficiency by directing individuals toward work.

Additional Reading

- Robert Rector, Rachel Sheffield, and Kevin Dayaratna, “Maine Food Stamp Work Requirement Cuts Non-Parent Caseload by 80 Percent,” Heritage Foundation Backgrounder No. 3091, February 8, 2016.

- Robert Rector and Rachel Sheffield, “Setting Priorities for Welfare Reform,” Heritage Foundation Issue Brief No. 4520, February 24, 2016.

Calculations

Savings of $9.7 billion per year come from analysis contained in Robert Rector, Rachel Sheffield, and Kevin Dayaratna, “Maine Food Stamp Work Requirement Cuts Non-Parent Caseload by 80 Percent,” Heritage Foundation Backgrounder No. 3091, February 8, 2016, http://www.heritage.org/research/reports/2016/02/maine-food-stamp-work-requirement-cuts-non-parent-caseload-by-80-percent. All $9.7 billion in savings represent mandatory spending.

END BROAD-BASED CATEGORICAL ELIGIBILITY FOR FOOD STAMPS

Recommendation

Broad-based categorical eligibility allows states to loosen income limits for potential food stamp recipients and bypass asset tests. This policy should be eliminated. This proposal saves $1.275 billion in FY 2018.

Rationale

Categorical eligibility traditionally allows individuals who receive cash welfare assistance—from programs such as Temporary Assistance for Needy Families (TANF)—to automatically enroll in food stamps. Now, a policy known as “broad-based categorical eligibility” provides a loophole that allows states to loosen income limits and bypass asset tests for potential food stamp recipients. Under broad-based categorical eligibility, individuals or families can simply receive some type of TANF “service” and become automatically categorically eligible for food stamps. A “service” can be something as simple as receiving a brochure from a TANF office. Because TANF services are available to households with incomes higher than those eligible for TANF cash assistance, states are able to extend food stamp benefits to those with higher incomes than otherwise would be permissible.

Furthermore, broad-based categorical eligibility allows states to entirely waive asset tests. An individual with temporary low income can receive a TANF service and then become categorically eligible for food stamps, even if he has a large amount of savings. Policymakers should end broad-based categorical eligibility to ensure that food stamps are focused on helping those truly in need.

Additional Reading

- Rachel Sheffield, “How to Reform Food Stamps,” Heritage Foundation Issue Brief No. 4045, September 12, 2013.

- Daren Bakst and Rachel Sheffield, “Eight Things to Watch for in the Farm Bill,” Heritage Foundation Issue Brief No. 4101, December 4, 2013.

Calculations

Savings are expressed as budget authority as estimated by the CBO in its analysis of the impact of previously proposed legislation that would enact these reforms as found in Congressional Budget Office, “Cost Estimate for H.R. 3102, the Nutrition Reform and Work Opportunity Act of 2013,” September 16, 2013, https://www.cbo.gov/sites/default/files/113th-congress-2013-2014/costestimate/hr31020.pdf (accessed February 6, 2017). Heritage uses the CBO’s estimated 2014 savings because these represent the first year of implementation. All $1.275 billion in savings represent mandatory spending.

ELIMINATE THE "HEAT AND EAT" LOOPHOLE IN FOOD STAMPS

Recommendation

Eliminate the “heat and eat” loophole in food stamps. This proposal saves $1.450 billion in FY 2018.

Rationale

A loophole known as “heat and eat” is a tactic that states have used to artificially boost a household’s food stamp benefit. The amount of food stamps a household receives is based on its “countable” income—income minus certain deductions. Households that receive benefits from the Low-Income Heat and Energy Assistance Program (LIHEAP) are eligible for a larger utility deduction. In order to make households eligible for the higher deduction—and, thus, greater food stamp benefits—states have distributed LIHEAP checks for amounts as small as $1 to food stamp recipients. While the 2014 farm bill tightened this loophole by requiring that a household receive greater than $20 annually in LIHEAP payments to be eligible for the larger utility deduction and subsequently higher food stamp benefits, some states have continued to utilize the loophole by paying over $20 per year. Policymakers should close this loophole entirely.

Additional Reading

- Rachel Sheffield, “How to Reform Food Stamps,” Heritage Foundation Issue Brief No. 4045, September 12, 2013.

- Daren Bakst and Rachel Sheffield, “Eight Things to Watch for in the Farm Bill,” Heritage Foundation Issue Brief No. 4101, December 4, 2013.

Calculations

Savings are based on the estimated FY 2018 savings of $1.450 billion reported for “Changes to SNAP Eligibility Requirements: Standard Utility Allowance,” as reported in Sequester Replacement Reconciliation Act of 2012, H.R. 5652, 112th Cong., p. 27, https://www.gpo.gov/fdsys/pkg/CRPT-112hrpt470/pdf/CRPT-112hrpt470.pdf (accessed February 6, 2017). All $1.450 billion in savings represent mandatory spending.

ELIMINATE THE FEDERAL SUGAR PROGRAM

Recommendation

Eliminate the federal sugar program. This proposal has no savings in FY 2018.

Rationale

The federal sugar program uses price supports and marketing allotments that limit how much sugar processors can sell each year, as well as import restrictions. As a result of government intervention to limit supply, the price of American sugar is consistently higher (at times twice as high) than world prices.[REF]

This program may benefit a small number of sugar growers and harvesters, but it does so at the expense of sugar-using industries and consumers. An International Trade Administration report found: “For each sugar-growing and harvesting job saved through high U.S. sugar prices, nearly three confectionery manufacturing jobs are lost.”[REF] The program is also a hidden tax on consumers. Recent studies have found that the program costs consumers as much as $3.7 billion a year.[REF] Such a program also has a disproportionate impact on the poor because a greater share of their income goes to food purchases than for individuals at higher income levels.

Additional Reading

- Daren Bakst et al., “Farms and Free Enterprise: A Blueprint for Agricultural Policy,” The Heritage Foundation, Mandate for Leadership Report, September 21, 2016.

- Daren Bakst, Josh Sewell, and Brian Wright, “Addressing Risk in Agriculture,” Heritage Foundation Special Report No. 189, September 8, 2016.

ELIMINATE REVENUE-BASED CROP INSURANCE POLICIES

Recommendation

Eliminate revenue-based crop-insurance policies. Although this proposal would likely save billions of dollars each year, Heritage does not include any savings for FY 2018. (See calculations below.)

Rationale

Any reasonable concept of a taxpayer-funded safety net for farmers would require a significant crop loss. Unfortunately, the current safety net, including the federal taxpayer-subsidized crop-insurance program, goes way beyond providing a safety net. The program does not require a disaster or even yield losses to have occurred for farmers to receive indemnities.

There are generally two types of federal crop-insurance policies: yield-based and revenue-based. A yield-based policy protects farmers from yields that are lower than expected due to events beyond the control of farmers, such as weather and crop disease. In 1997, revenue-based insurance became an option for farmers.[REF] By 2003, more acreage was covered by these policies than yield-based policies.[REF] In other words, these revenue-based policies have not been around a long time, and it has been only a little over 10 years since they have been more prominent than yield-based policies.

Revenue-based policies are more popular than yield-based policies because they do not require yield losses. They accounted for 77 percent of all policies earning premiums in 2014.[REF] Farmers can even have greater yields than expected and still receive indemnity payments if commodity prices are lower than expected. A revenue-based policy protects farmers from dips in expected revenue due to low prices, low yields, or both. The federal government should not be in the business of insuring price or revenue; agricultural producers, like other businesses, should not be insulated from market forces or guaranteed financial success at the expense of taxpayers.

This relatively new and overly generous type of taxpayer-subsidized crop insurance should be eliminated. Farmers would still be able to purchase taxpayer-subsidized crop insurance, but it would be limited to yield insurance as it has been in the past. Such a change would lead to major savings (likely in the billions).

Additional Reading

- Daren Bakst et al., “Farms and Free Enterprise: A Blueprint for Agricultural Policy,” The Heritage Foundation, Mandate for Leadership Report, September 21, 2016.

- Daren Bakst, Josh Sewell, and Brian Wright, “Addressing Risk in Agriculture,” Heritage Foundation Special Report No. 189, September 8, 2016.

Calculations

We do not yet include any estimated savings for FY 2018 because, absent an extensive analysis, many unknown factors remain that are necessary for providing a reasonable estimate. Among other factors, savings would be contingent on which coverage, if any, agricultural producers select as a result of this change.

ELIMINATE THE MARKET ACCESS PROGRAM

Recommendation

Eliminate the USDA’s Market Access Program (MAP). This proposal saves $185 million in FY 2018.

Rationale

MAP subsidizes trade associations, businesses, and other private entities to help them market and promote their products overseas. Under MAP, taxpayers have recently helped to fund international wine tastings, organic hair products for cats and dogs, and a reality television show in India. It is not government’s role to advance the marketing interests of certain industries or businesses. Taxpayers should not be forced to subsidize the marketing that private businesses should do on their own.

Additional Reading

- Daren Bakst, “Addressing Waste, Abuse, and Extremism in USDA Programs,” Heritage Foundation Backgrounder No. 2916, May 30, 2014.

- Daren Bakst, “Animated Squirrels, Prunes, and Doggie Hair Gel: Your Tax Dollars at Work,” The Daily Signal, July 25, 2013.

- Senator Tom Coburn, “Treasure Map: The Market Access Program’s Bounty of Waste, Loot and Spoils Plundered from Taxpayers,” June 2012.

Calculations

Savings are expressed as budget authority as projected for FY 2018 in Congressional Budget Office, “CBO’s March 2016 Baseline for Farm Programs,” March 24, 2016, https://www.cbo.gov/sites/default/files/recurringdata/51317-2016-03-usda.pdf (accessed February 6, 2017). (The CBO’s more recent August 2016 baseline projections did not include estimates for MAP). All $185 million in savings represent mandatory spending.

SECTION 2: Commerce, Justice, Science, and Related Agencies

ELIMINATE THE OFFICE OF COMMUNITY ORIENTED POLICING SERVICES

Recommendation

Eliminate the Office of Community Oriented Policing Services (COPS). This proposal saves $158 million in FY 2018.

Rationale

Created in 1994, COPS promised to add 100,000 new state and local law enforcement officers to America’s streets by 2000. COPS failed to add 100,000 additional officers, and failed at reducing crime.

State and local officials, not the federal government, are responsible for funding the staffing levels of police departments. By paying for the salaries of police officers, COPS funds the routine, day-to-day functions of police and fire departments. In Federalist No. 45, James Madison wrote:

The powers delegated by the proposed Constitution to the federal government are few and defined. Those which are to remain in the State governments are numerous and indefinite. The former will be exercised principally on external objects, as war, peace, negotiation, and foreign commerce; with which last the power of taxation will, for the most part, be connected. The powers reserved to the several States will extend to all the objects which, in the ordinary course of affairs, concern the lives, liberties, and properties of the people, and the internal order, improvement, and prosperity of the State.

When Congress subsidizes local police departments in this manner, it effectively reassigns to the federal government the powers and responsibilities that fall squarely within the expertise, historical control, and constitutional authority of state and local governments. The responsibility to combat ordinary crime at the local level belongs almost wholly, if not exclusively, to state and local governments.

The COPS program has an extensive track record of poor performance and should be eliminated. COPS grants also unnecessarily fund functions that are the responsibility of state and local governments.

Additional Reading

- David B. Muhlhausen, “Byrne JAG and COPS Grant Funding Will Not Stimulate the Economy,” Heritage Foundation Testimony on Economy before the Judiciary Committee, U.S. Senate, May 12, 2009.

- David B. Muhlhausen, “Impact Evaluation of COPS Grants in Large Cities,” Heritage Foundation Center for Data Analysis Report No. 06-03, May 26, 2006.

Calculations

Savings are expressed as budget authority as projected for FY 2018 in the CBO’s August 2016 baseline spending projections.

ELIMINATE GRANTS WITHIN THE OFFICE OF JUSTICE PROGRAMS

Recommendation

Eliminate state and local grants administered by the Office of Justice Programs (OJP). This proposal saves $2.119 billion in FY 2018.

Rationale

The majority of the programs under the OJP umbrella deal with problems or functions that lie within the jurisdiction of state and local governments, and should therefore be handled by state and local officials. Grants from the OJP are given to state and local governments for many criminal justice purposes, including local police officer salaries, state corrections, court programs, and juvenile justice programs.

In order to address criminal activity appropriately, the federal government should limit itself to handling tasks that state and local governments cannot perform by themselves and that the Constitution commits to the federal government. The tendency to search for a solution at the national level is misguided and problematic. For example, juvenile delinquents and criminal gangs are a problem common to all states, but the crimes that they commit are almost entirely and inherently local in nature, and are therefore regulated by state criminal law, state law enforcement, and state courts. The fact that thefts by juveniles occur in all states does not mean that these thefts are a problem requiring action by the federal government.

State and local officials, not the federal government, are responsible for funding the state and local criminal justice programs. The OJP subsidizes the routine, day-to-day functions of state and local criminal justice programs. When Congress subsidizes routine state and local criminal justice programs in this manner, it effectively reassigns to the federal government the powers and responsibilities that fall squarely within the expertise, historical control, and constitutional authority of state and local governments. The responsibility to combat ordinary crime at the local level belongs almost wholly, if not exclusively, to state and local governments.

Additional Reading

- David B. Muhlhausen, “Byrne JAG and COPS Grant Funding Will Not Stimulate the Economy,” statement before the Judiciary Committee, U.S. Senate, May 12, 2009.

- David B. Muhlhausen, “Drug and Veterans Treatment Courts: Budget Restraint and More Evaluations of Effectiveness Needed,” testimony before the Subcommittee on Crime and Terrorism, Committee on the Judiciary, U.S. Senate, July 19, 2011.

- David B. Muhlhausen, “Get Out of Jail Free: Taxpayer-Funded Grants Place Criminals on the Street Without Posting Bail,” Heritage Foundation WebMemo No. 3361, September 12, 2011.

- David B. Muhlhausen, “The Second Chance Act: Budget Restraint and More Evaluations of Effectiveness Needed,” testimony before the Subcommittee on Crime, Terrorism, and Homeland Security, Committee on the Judiciary, U.S. House of Representatives, September 29, 2010.

- David B. Muhlhausen, “Where the Justice Department Can Find $2.6 Billion for its Anti-Terrorism Efforts,” Heritage Foundation Backgrounder No. 1486, October 5, 2001.

- David B. Muhlhausen, “The Youth PROMISE Act: Outside the Scope and Expertise of the Federal Government,” testimony before the Subcommittee on Crime, Terrorism, and Homeland Security, Committee on the Judiciary, U.S. House of Representatives, July 15, 2009.

Calculations

Savings are expressed as budget authority as projected for FY 2018 in the CBO’s August 2016 baseline spending projections.

ELIMINATE VIOLENCE AGAINST WOMEN ACT GRANTS

Recommendation

Eliminate Violence Against Women Act (VAWA) grants. This proposal saves $83 million in FY 2018.

Rationale

VAWA grants should be terminated because these services should be funded and implemented locally. Using federal agencies to fund the routine operations of domestic violence programs that state and local governments could provide is a misuse of federal resources and a distraction from concerns that are the province of the federal government. Moreover, funneling state resources back to the states through the federal government reduces the overall resources as some funds go toward unnecessary federal administration.

The principal reasons for the existence of the VAWA programs are to mitigate, reduce, or prevent the effects and occurrence of domestic violence. Despite being created in 1994, grant programs under the VAWA have not undergone nationally representative, scientifically rigorous experimental evaluations of effectiveness.

The Government Accountability Office concluded that previous evaluations of the VAWA programs “demonstrated a variety of methodological limitations, raising concerns as to whether the evaluations will produce definitive results.” Further, the evaluations were not representative of the types of programs funded nationally by the VAWA.

Additional Reading

- Paul J. Larkin Jr., “Send in the Lawyers: The House Passes the Senate’s Violence Against Women Act,” The Daily Signal, March 1, 2013.

- David B. Muhlhausen, “Violence Against Women Act Gives Grant Money to Misleading Organizations,” The Daily Signal, February 13, 2013.

- David B. Muhlhausen and Christina Villegas, “Violence Against Women Act: Reauthorization Fundamentally Flawed,” Heritage Foundation Backgrounder No. 2673, March 29, 2012.

- U.S. Government Accountability Office, “Justice Impact Evaluations: One Byrne Evaluation was Rigorous; All Reviewed Violence Against Women Office Evaluations Were Problematic,” March 2002.

Calculations

Savings are expressed as budget authority as projected for FY 2018 in the CBO’s August 2016 baseline spending projections.

ELIMINATE THE LEGAL SERVICES CORPORATION

Recommendation

Eliminate the Legal Services Corporation (LSC). This proposal saves $484 million in FY 2018.

Rationale

The LSC was created by the Legal Services Act of 1974 as a means to provide civil legal assistance to indigent clients. It does so by distributing federal grant funds in one-year to three-year award increments to service areas throughout the United States and its territories. The annual appropriations legislation specifies the types of activities for which the funds may be used, and also restricts certain uses, such as for political activities, advocacy, demonstrations, strikes, class-action lawsuits, and cases involving abortion, partisan redistricting, and welfare reform.

LSC grants do help provide high-quality civil legal assistance to some low-income Americans. Nevertheless, the Congressional Budget Office has repeatedly listed LSC elimination among its deficit-reduction options, citing that many programs receiving LSC grants already receive resources from state and local governments and private entities.

LSC also should be abolished because state and local governments, supplemented by donations from other outside sources, already provide funding for indigent legal defense and are better equipped to address the needs of those in their communities who rely on these free services. By giving local entities sole responsibility for these activities, funds can be targeted in the most efficient manner, and the burden can be removed from the federal deficit.

Additional Reading

- Kenneth F. Boehm and Peter T. Flaherty, “Why the Legal Services Corporation Must Be Abolished,” Heritage Foundation Backgrounder No. 1057, October 19, 1995.

- Congressional Budget Office, “Budget Options Volume 2,” August 6, 2009.

- National Legal and Policy Center Staff, “What the Legal Services Corporation Doesn’t Want Congress to Know,” National Legal and Policy Center, March 22, 2012.

Calculations

Savings are expressed as budget authority as projected for FY 2018 in the CBO’s August 2016 baseline spending projections.

REDUCE FUNDING FOR THE DEPARTMENT OF JUSTICE'S CIVIL RIGHTS DIVISION

Recommendation

Reduce funding for the Department of Justice’s Civil Rights Division by 33 percent. This saves $49 million in FY 2018.

Rationale

A recent report by the Justice Department Inspector General described the Civil Rights Division as a dysfunctional division torn by “polarization and mistrust.”[REF] It is a division that has fought election integrity and filed abusive lawsuits intended to enforce progressive social ideology in areas ranging from public hiring to public education.[REF] At a time when there is less discrimination than we have ever had in our society, the division is at its largest, far larger that in was in the 1960s when it was fighting crucial civil rights battles. It has far more employees than are needed to vigorously enforce civil rights and voting rights laws and its budget can be significantly cut while maintaining its efficiency and ability to protect the public from discrimination.

Additional Reading